Layoffs fall to a 17-month low, recruitment intentions heat up, and the US labor market picks up on the eve of 2026

The Zhitong Finance App learned that the latest statistics show that the number of layoffs announced by US companies last month has decreased, and plans are also planning to increase recruitment, which may ease economists' negative concerns about a more sharp slowdown in the US labor market. At the same time, this data marginally reinforces the “soft landing” narrative. The US labor market presents a combination of “easing layoffs + recovering recruitment intentions”, which is basically in line with the “slowing growth without stalling” employment picture required for the economy's soft landing trajectory.

In the US market, several job market statistics for December show that after experiencing an obvious slowdown in recruitment in 2025, the labor market showed a certain degree of optimistic growth momentum as it entered the new year, which is certainly positive news for the US economic growth prospects in 2026.

According to statistics from the US job placement agency Challenger, Gray & Christmas Inc. (that is, the number of layoffs at US challenger companies), US companies announced 35,553 job cuts in December, which unexpectedly hit the lowest level since July 2024, and is a significant drop from the high level of layoffs in the previous two months. Furthermore, according to survey data, US employers plan to add nearly 10,500 new jobs. The supermarket market is in agreement with expectations, and this is the highest level in any December since 2022. Notably, after being accessed by the Challenger website crawler, the data was released ahead of schedule at 8:30 a.m. EST.

Although December is generally a month with relatively few layoffs, the decline in layoffs announcements, combined with stronger corporate recruitment intentions than the market's unanimous expectations, “is a positive sign after a year of high layoff plans,” said Andy Challenger, the company's chief revenue officer.

These data show that after a significant slowdown in non-farm payrolls data in 2025, the US labor market still has a certain amount of growth momentum as it enters the new year. According to Challenger statistics, US companies planned to lay off more than 1.2 million workers last year, the largest since 2020, and is dominated by the US federal government. In the US private sector, the technology, warehousing, logistics, and retail industries also saw a significant increase in the scale of layoffs compared to 2024.

Although the overall recruitment plans of US companies performed more strongly at the end of the year, the full year of 2025 will still be the lowest level of recruitment since 2010. In particular, compared to the previous year, retail and transportation companies in the US contracted sharply, as did the energy and construction industries.

The data released by the American Institute for Supply Management (ISM) on Wednesday also brought some encouragement at the “soft landing” narrative level at the end of the year: US service provider employment growth last month hit the strongest growth level since February. The service sector PMI rose to 54.4 in December, and the service sector employment segment rebounded to 52.0 (returning to the expansion range suggested above 50 points), indicating that employment in the service sector improved at the end of the year. However, the agency's index for measuring the number of workers employed in the manufacturing industry has been shrinking for 11 consecutive months, although the rate of contraction has slowed significantly compared to previous months.

The “no collapse” in employment means that the Federal Reserve does not need to cut interest rates quickly in order to save employment; at the same time, the ISM service industry's price index is still high (64.3), strengthening the “inflationary stickiness” constraint, so that the market begins pricing “interest rate cuts can occur in 2026, but they may not necessarily present a state of emergency.”

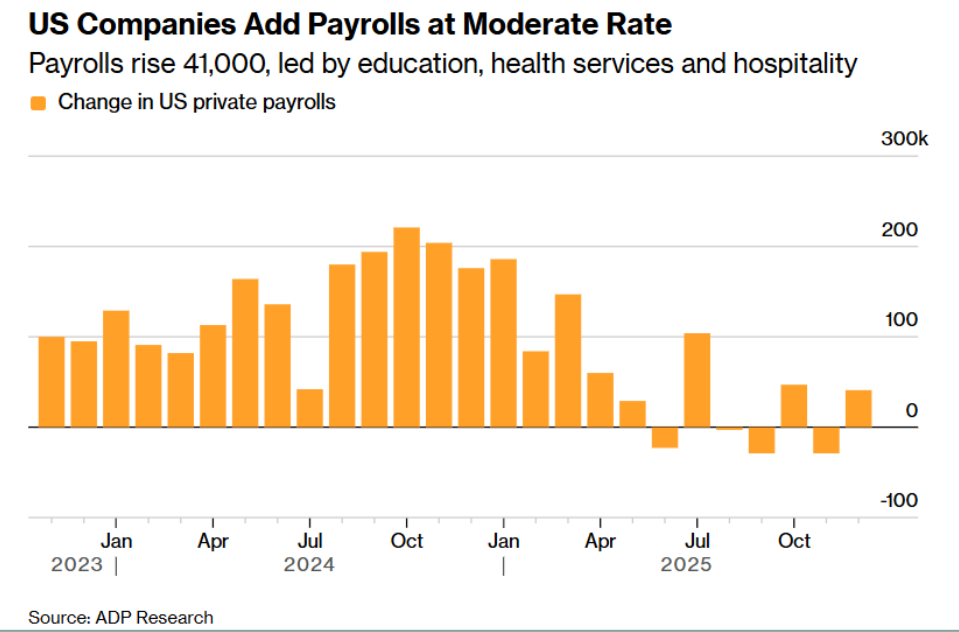

The “small non-farmers” data released on Wednesday — ADP Research's US private sector employment data — also sent a relatively positive signal about the US labor market. The overall number of people employed in the US private sector increased by 41,000 in December. There was a significant decline in the previous month, highlighting that the pace of recruitment by US companies rebounded slightly at a moderate pace in December, indicating that the US economy was still resilient until 2026. In contrast, “small farmers” fell short of the more optimistic market consensus expectations in December. According to a survey of economists, economists generally expected an increase of about 50,000 people.

ADP added 41,000 new private sector accounts for December, a marked recovery from November (revised -29,000), but it did show a delicate balance of “cooling recruitment but not completely stalled” — neither strong enough to cause the market to worry that “demand is overheating, to the point where expectations of interest rate cuts are greatly cooling due to the return of the monster of inflation”, nor weak enough to instantly break the “soft landing” of the US economy as a sign of a major recession.