Siemens Energy (XTRA:ENR) Is Up 7.5% After Winning One‑Gigawatt AI Data Center Power Deal

- Babcock & Wilcox recently selected Siemens Energy to supply steam turbine generator sets for its project to deliver one gigawatt of power to Applied Digital’s AI Factory, under a limited notice to proceed that aims to secure equipment in time for targeted power delivery by the end of 2028.

- This agreement highlights Siemens Energy’s growing role in powering energy-intensive AI data centers, potentially enhancing the company’s positioning in the broader grid and generation equipment market.

- We’ll now examine how winning a one‑gigawatt AI data center power contract might influence Siemens Energy’s existing investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Siemens Energy Investment Narrative Recap

To own Siemens Energy, you need to believe it can turn a large, diversified €136 billion backlog and strong energy transition exposure into sustainably higher earnings, while controlling execution risks, especially at Siemens Gamesa. The new one gigawatt AI data center power contract with Babcock & Wilcox supports the short term catalyst of growing demand from power intensive data centers, but does not fundamentally change the key risk around wind division profitability.

The most relevant recent announcement here is Siemens Energy’s June 2025 collaboration with Eaton to offer modular 500 megawatt on site power solutions for data centers, using its SGT 800 turbines and optional low carbon configurations. Combined with the Babcock & Wilcox win, this reinforces the company’s positioning in supplying both grid and on site generation equipment to energy hungry AI and cloud facilities, directly tied to its core growth catalyst of rising electrification needs.

However, while these AI related wins are encouraging, investors should still be aware of...

Read the full narrative on Siemens Energy (it's free!)

Siemens Energy's narrative projects €48.7 billion revenue and €3.6 billion earnings by 2028.

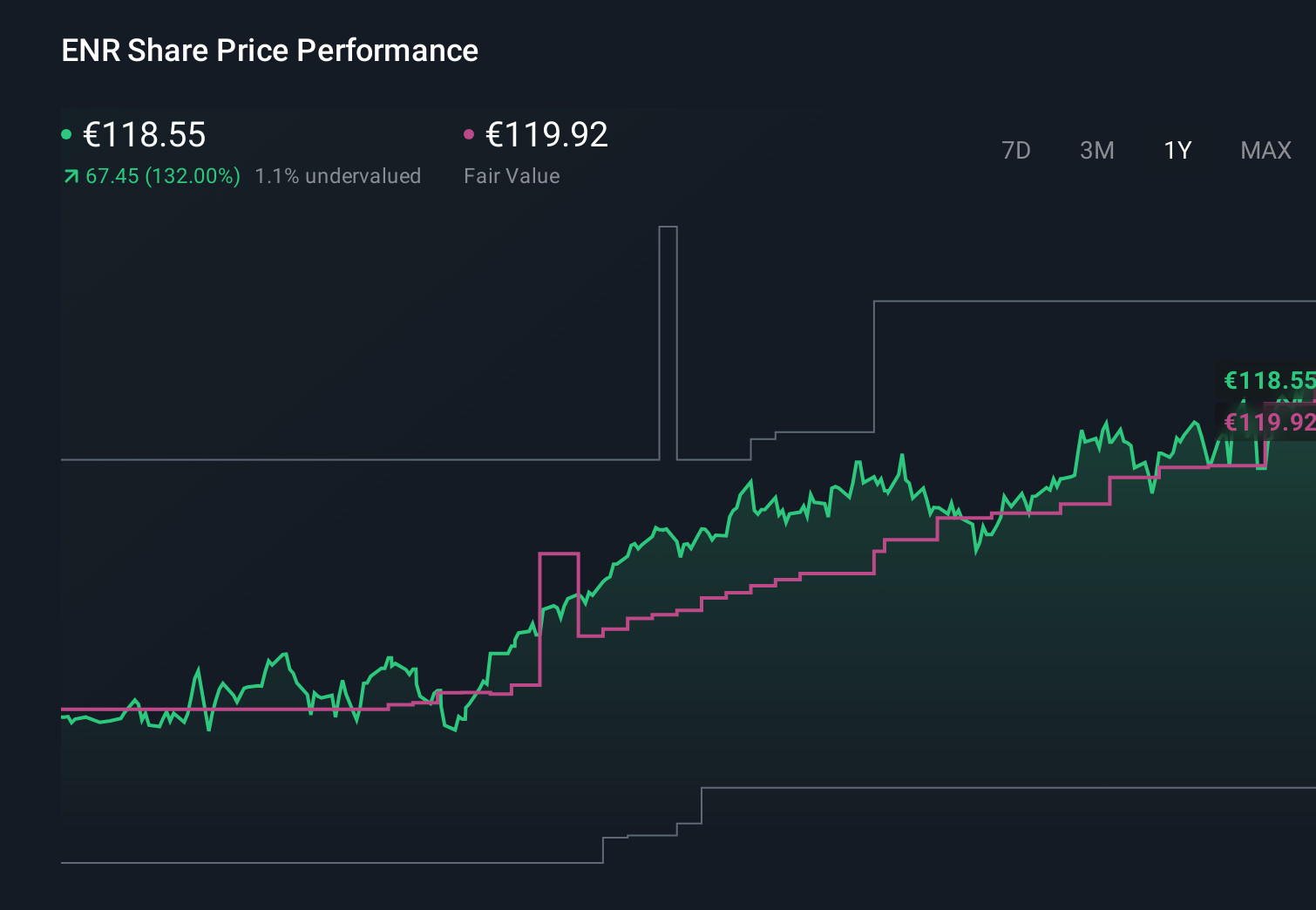

Uncover how Siemens Energy's forecasts yield a €125.04 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community span roughly €29 to €149 per share, showing how far apart views can be. You can weigh those against Siemens Energy’s record order backlog and AI data center exposure, both of which could influence how the business performs over time.

Explore 11 other fair value estimates on Siemens Energy - why the stock might be worth as much as 15% more than the current price!

Build Your Own Siemens Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Siemens Energy research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Siemens Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Siemens Energy's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com