3 UK Penny Stocks With Market Caps Above £10M

The UK market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices closing lower due to weak trade data from China, highlighting the interconnectedness of global economies. Despite these challenges, investors often seek opportunities in less conventional areas of the market. Penny stocks, although an outdated term, continue to attract attention as they represent smaller or newer companies that can offer growth potential at lower price points when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.31 | £494.97M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.92 | £155.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.85 | £138.03M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £1.105 | £16.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.72 | $418.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.83 | £75.24M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.462 | £177.07M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.535 | £74.11M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.46 | £39.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.16 | £186.68M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 293 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Eleco (AIM:ELCO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eleco plc is a software and services provider operating in the UK, Scandinavia, Germany, Europe, the US, and internationally with a market cap of £110.50 million.

Operations: The company generates £34.50 million in revenue from its software segment.

Market Cap: £110.5M

Eleco plc, with a market cap of £110.50 million and revenue of £34.50 million from its software segment, presents a promising profile for penny stock investors due to its stable financial health and growth trajectory. The company has eliminated debt over the past five years, enhancing its balance sheet strength. Earnings have grown significantly by 27.3% over the past year, outpacing both its historical average and industry growth rates. Despite having low return on equity at 11.7%, Eleco's net profit margins improved to 10.7%, and it is trading below analyst price targets with high-quality earnings reported consistently.

- Click here and access our complete financial health analysis report to understand the dynamics of Eleco.

- Examine Eleco's earnings growth report to understand how analysts expect it to perform.

Water Intelligence (AIM:WATR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Water Intelligence plc, with a market cap of £52.83 million, offers leak detection and remediation services for both potable and non-potable water across the United States, the United Kingdom, Ireland, Australia, Canada, and other international markets.

Operations: The company's revenue is primarily derived from US Corporate Operated Locations ($57.89 million), supplemented by Franchise Related Activities ($11.61 million), International Corporate Operated Locations ($12.93 million), and Franchise Royalty Income ($6.16 million).

Market Cap: £52.83M

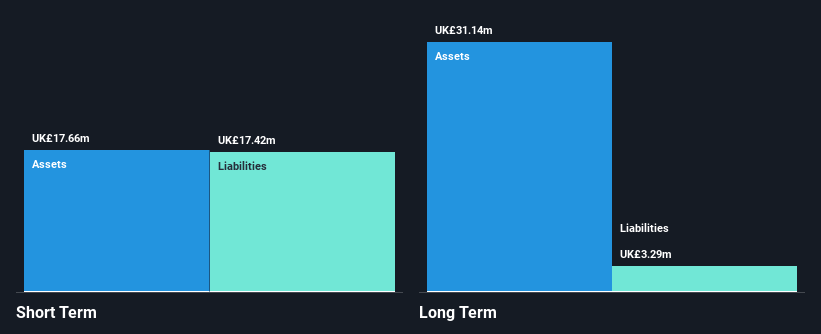

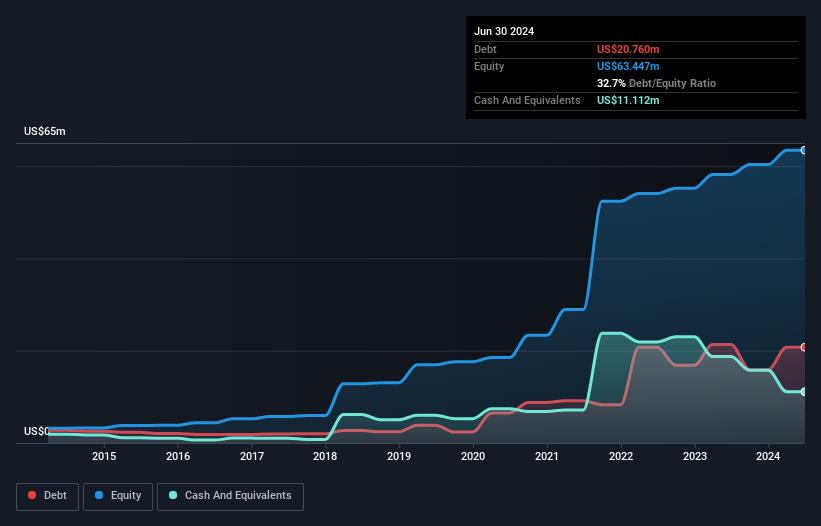

Water Intelligence plc, with a market cap of £52.83 million, has a diverse revenue stream primarily from US Corporate Operated Locations (US$57.89 million) and Franchise Related Activities (US$11.61 million). The company’s debt is well covered by operating cash flow at 40.5%, and interest payments are adequately managed with EBIT covering them 4.1 times over. However, short-term assets of US$22.5 million do not cover its long-term liabilities of US$36.2 million, posing potential financial challenges despite having high-quality earnings and an experienced management team with stable weekly volatility at 6%. Earnings are forecast to grow by 18.37% annually, offering growth potential amid recent negative earnings trends (-8.8%).

- Dive into the specifics of Water Intelligence here with our thorough balance sheet health report.

- Explore Water Intelligence's analyst forecasts in our growth report.

Westmount Energy (AIM:WTE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Westmount Energy Limited is a venture capital firm that focuses on providing seed capital to small and medium-sized companies, with a market cap of £10.80 million.

Operations: Westmount Energy Limited does not report any specific revenue segments.

Market Cap: £10.8M

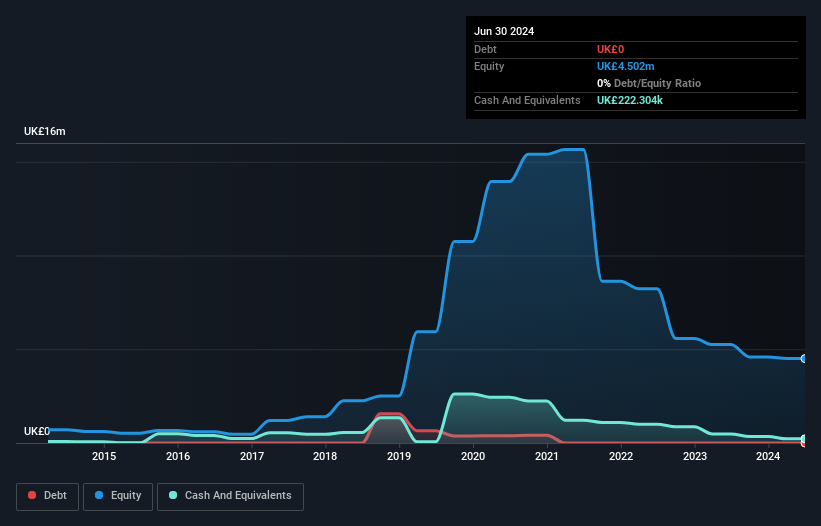

Westmount Energy Limited, with a market cap of £10.80 million, is pre-revenue and unprofitable but has been reducing its losses at 14.1% annually over the past five years. The company is debt-free and has sufficient cash runway for more than a year, covering short-term liabilities with assets of £473.4K against £58.9K in liabilities. Despite high share price volatility and negative return on equity (-13.97%), shareholders have not experienced significant dilution recently, and the board boasts an average tenure of 14.1 years, indicating seasoned leadership amidst financial challenges.

- Click to explore a detailed breakdown of our findings in Westmount Energy's financial health report.

- Assess Westmount Energy's previous results with our detailed historical performance reports.

Seize The Opportunity

- Click this link to deep-dive into the 293 companies within our UK Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com