MSTR Stock Breaks Above 20-Day Moving Average on MSCI Win. Should You Buy Shares Here?

MicroStrategy (MSTR) shares pushed higher on Jan. 7 after MSCI said it will retain digital asset treasury companies within its global indexes, eliminating months of delisting uncertainty.

The rally saw MSTR break above a key resistance, aligning with its 20-day moving average (MA), indicating the bullish momentum may accelerate in the near term.

Despite Wednesday’s surge, MicroStrategy stock remains down over 60% versus its 52-week high.

MicroStrategy Stock Isn’t Out of the Woods Just Yet

The MSCI announcement is significant for MSTR stock as the feared delisting would have resulted in some $2.8 billion in forced selling from passive index funds.

Still, it isn’t an “all-clear” for investors. Why? Partly because the MSCI decision carries substantial limitations, including intention to conduct broader consultations on non-operating firms.

Additionally, the index provider has established new constraints – discontinuing automatic passive fund purchases when the company issues equity for Bitcoin (BTCUSD) acquisition.

Note that MicroStrategy’s market-to-net-asset-value (NAV) recently dropped below 1, restricting its ability to fund continued BTC accumulation without creating per-share dilution.

This presents a structural headwind against sustained upside momentum.

MSTR Shares Are Still Egregiously Overvalued

Investors must tread with caution on MicroStrategy shares also because they are currently trading at a stretched price-sales (P/S) multiple of more than 94x.

At writing, the Nasdaq-listed firm is trading at north of 20% discount to its Bitcoin net asset value, signaling the market remains skeptical about its ability to generate returns beyond crypto holdings.

MSTR’s unrealized loss of $17.4 billion on digital assets in Q4 underscores the inherent volatility accompanying a treasury strategy so heavily dependent on BTC price action.

Moreover, the company’s long-term relative strength index (100-day) sits at about 44 currently, substantiating that the Bitcoin-proxy isn’t yet in oversold territory and could tumble further in the months ahead.

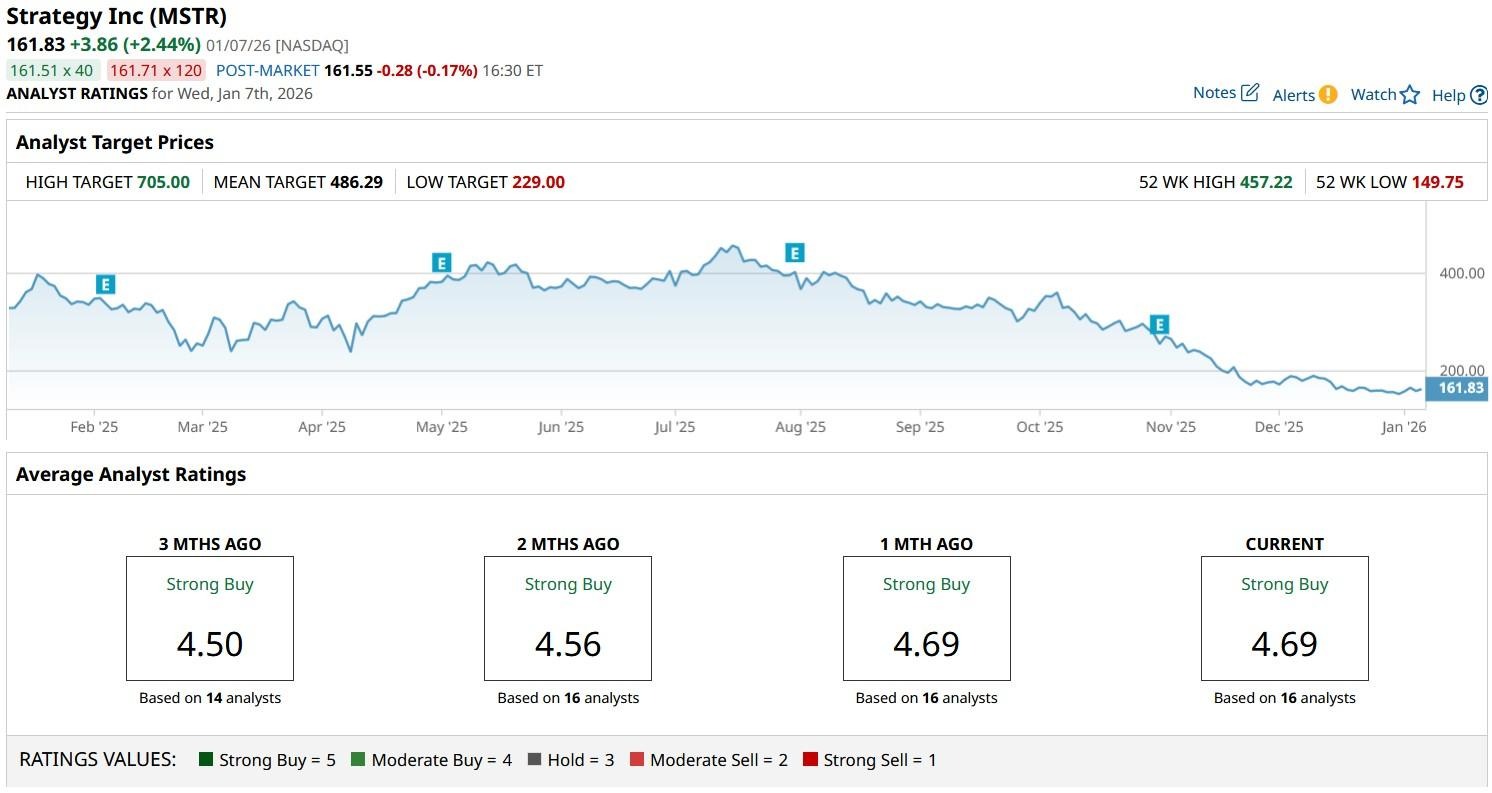

What’s the Consensus Rating on MicroStrategy?

Despite the aforementioned challenges, Wall Street firms remain bullish as ever on MSTR shares for the next 12 months.

According to Barchart, the consensus rating on MicroStrategy stock sits at “Strong Buy” currently with the mean target of about $486 indicating potential upside of a whopping 200% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.