US stock outlook | Futures on the three major stock indexes are falling sharply, Trump plans to increase defense spending by 500 billion dollars a year, and the defense sector soars ahead of the market

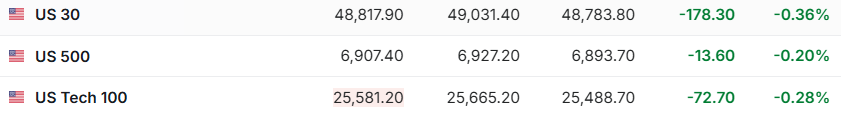

1. On January 8 (Thursday), the futures of the three major US stock indexes fell sharply before the US stock market. As of press release, Dow futures were down 0.36%, S&P 500 futures were down 0.20%, and NASDAQ futures were down 0.28%.

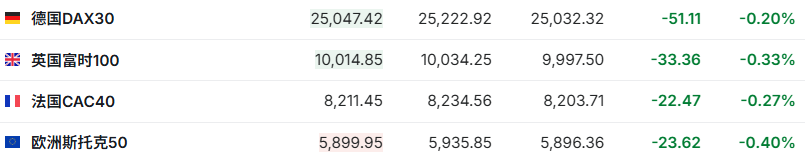

2. As of press release, the German DAX index fell 0.20%, the UK FTSE 100 index fell 0.33%, the French CAC40 index fell 0.27%, and the European Stoxx 50 index fell 0.40%.

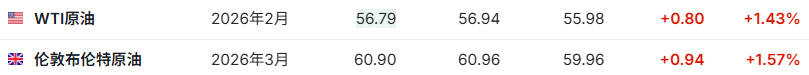

3. As of press release, WTI crude oil rose 1.43% to $56.79 per barrel. Brent crude rose 1.57% to $60.90 per barrel.

Market news

Trump plans to increase defense spending by 500 billion dollars a year, and the defense sector soars ahead of the market. At the beginning of 2026, due to the highly tense global geopolitical situation and the US government's plans to drastically expand armaments, the global defense sector experienced a collective surge and became the focus of market attention. Although Trump signed an executive order restricting defense contractors from repurchasing shares, paying dividends, and capping the annual salary of executives at $5 million in an attempt to force companies to shift capital to capacity expansion and technology research and development, his grand plan to increase the defense budget by 500 billion US dollars per year proposed on Wednesday completely detonated the market. Earlier, it was reported that Trump is asking the US to increase annual defense spending by more than 50% to reach 1.5 trillion US dollars in 2027. This positive news drove US stock giants such as Northrop Grumman (NOC.US) and Lockheed Martin (LMT.US) to surge more than 8% in the pre-market on Thursday, successfully recovering from the previous day's decline.

Layoffs fell to a 17-month low, recruitment intentions heated up, and the US labor market picked up on the eve of 2026. According to the latest statistics, the number of layoffs announced by US companies last month has decreased, while planning to increase recruitment, which may ease economists' negative concerns about a more sharp slowdown in the US labor market. At the same time, this data marginally reinforces the “soft landing” narrative. The US labor market presents a combination of “easing layoffs + recovering recruitment intentions”, which is basically in line with the “slowing growth without stalling” employment picture required for the economy's soft landing trajectory. In the US market, several job market statistics for December show that after experiencing an obvious slowdown in recruitment in 2025, the labor market showed a certain degree of optimistic growth momentum as it entered the new year, which is certainly positive news for the US economic growth prospects in 2026.

Federal Reserve Bowman: Bank rating systems and regulatory thresholds are being re-examined. Federal Reserve Vice Chairman Bauman said that the Federal Reserve is re-examining its method of rating some banks, continuing a broader effort initiated during Trump's time to refocus the regulatory focus on issues that pose a major risk to banks. Bauman said that the Federal Reserve is also studying various regulatory thresholds as part of the regulatory process and will cooperate with legislators to update rules that seem too low compared to the overall economy. “One simple solution is to adjust these thresholds according to nominal GDP, which includes both economic growth and inflation factors,” she said.

With the rise of the middle class in the US, Goldman Sachs is betting on the 2026 “consumer cow” of US stocks to take over AI. Wall Street strategists are actively searching for new growth engines for the US stock market as market concerns about the cooling of the artificial intelligence (AI) related trading boom. A team of Goldman Sachs analysts led by Ben Snider has their sights set on companies benefiting from increased middle class consumer spending. The Snider team is optimistic about medical service providers, material manufacturers, and essential consumer goods manufacturers, and is particularly bullish on companies that sell “icing on the cake” products that are not just needed. Goldman Sachs's team analysis indicates that the growth rate of the US economy is expected to accelerate, which will drive a number of companies with stable growth but low profit margins to improve profits. At the same time, the bank also released five major predictions for US stocks in 2026. The S&P 500 index is expected to rise to 7,600 points by the end of the year (an increase of about 12%), and mergers and acquisitions will continue to be active due to the relaxation of financial conditions.

Competing against OpenAI! Anthropic plans to raise 10 billion dollars at a valuation of 350 billion US dollars, and Microsoft and Nvidia will continue to raise funds. According to people familiar with the matter, artificial intelligence startup Anthropic (developer of the chatbot Claude) is undergoing a new round of financing, and the company's valuation before this investment is expected to reach an astonishing 350 billion US dollars. One of the people familiar with the matter, who asked for anonymity, said that the AI developer is in negotiations to raise $10 billion. According to reports, Singapore's sovereign wealth fund GIC and hedge fund Coatue Management plan to lead this round of financing. A source said that the total amount of financing is still likely to change. According to previous reports, Microsoft (MSFT.US) and Nvidia (NVDA.US) have previously announced that they will jointly invest up to $15 billion in Anthropic, and it is expected that they will also participate in this round of financing.

Individual stock news

AI spawned a “memory shortage” and a “wave of storage price increases” detonated Samsung Electronics' (SSNLF.US) Q4 performance: operating profit increased 208% year-on-year, and reached a new high with revenue. As global demand for artificial intelligence servers boosted the price of memory chips, Samsung Electronics' quarterly profit more than tripled, reaching a record high. In the three months ending December, Samsung Electronics' initial operating profit was 20 trillion won (US$13.8 billion), up 208% year over year, exceeding analysts' average expectations. Revenue increased 23% to 93 trillion won, which also reached a record high. The company's stock price rose 2.5% in early Thursday trading in Seoul, continuing the 20% increase since the beginning of the year. Rival SK Hynix's shares rose 6.2%.

TSM.US (TSM.US) 3nm process is in short supply: raise the price and suspend the launch of the new project. TSMC's advanced manufacturing processes maintain high capacity utilization rates, with the 3nm process continuing to be in short supply. Chip industry insiders revealed that in addition to raising the 3nm price this year, TSMC has temporarily stopped launching a new 3nm project. According to industry insiders, the main reason is that orders are full, existing production capacity is already difficult to load, and it is difficult to keep up with the influx of customer demand in the short term. TSMC is encouraging customers who are still in the early stages of product planning to directly evaluate and implement the 2nm process to facilitate subsequent mass production and cost allocation. As of press time, TSMC had previously risen 1.31% to $322.85.

ABBV.US (ABBV.US) denied negotiations to acquire cancer drug developer Revolution (RVMD.US). AbbVie said the company is not in negotiations to acquire Revolution Medicines, a biotech company focused on cancer. Affected by this news, Revolution Medicines's US stocks fell nearly 7% in the premarket on Thursday. There were reports on Wednesday that AbbVie is in “deep” negotiations to acquire Revolution Medicines, a deal that could value the latter company, which has yet to go public, at more than $20 billion. Driven by this news, Revolution Medicines' U.S. stocks closed up more than 28% on Wednesday.

Deeply involved in Norway and rejected Venezuela: Equinor (EQNR.US) spent 100 billion dollars to protect Europe's “energy lifeline.” Norwegian energy giant Equinor has signed a contract worth approximately NOK 100 billion (equivalent to $9.9 billion) to help maintain current oil and gas production levels in Norway for at least the next ten years. The company's CEO Anders Opedal (Anders Opedal) described the Norwegian continental shelf as Equinor's “mainstay” and emphasized its importance to European energy security. Since the Russian-Ukrainian conflict escalated, this Nordic country has been Europe's largest gas supplier for three consecutive years. Meanwhile, Equinor's CEO Opedal also said on Wednesday that the company would not consider returning to the Venezuelan market, which it had left many years ago. On the sidelines of a business event in Oslo, Oppedar said: “Currently, this is not within our scope of consideration.”

HSBC Holdings (HSBC.US) agreed to pay 300 million euros to settle the French “Cum-Cum” tax scandal. HSBC Holdings agreed to pay about 300 million euros (equivalent to 350 million US dollars) to settle the dual criminal and tax investigation initiated by France against its involvement in the so-called “Cum-Cum” dividend tax avoidance scandal. A Paris judge outlined the settlement agreement in court on Thursday and will decide whether to approve it later. If the agreement is approved, the investigation of HSBC by the French National Financial Prosecution Service will be terminated without the bank admitting misconduct. The agreement includes fines of around €268 million and about €30 million in taxes already paid by HSBC. HSBC representative Benjamin Rossan said in court on Thursday that the bank acknowledged the basic facts and that the transactions involved in the case were completed by its Paris traders between 2014 and 2019. He also added that “French taxes were not paid in full on the relevant transactions at the time.”

Key economic data and event forecasts

21:30 Beijing time: Number of jobless claims in the US at the beginning of the week ending January 3 (10,000).

23:00 Beijing time: Revised monthly US wholesale inventory rate for October (%).

00:00 a.m. Beijing time the next day: The US New York Federal Reserve's 1-year inflation forecast for December (%).