Wave Life Sciences (WVE) Valuation In Focus As Obesity Data, Equity Raise And Conference Updates Draw Attention

Wave Life Sciences (WVE) has been in focus as investors look ahead to Phase 1 follow up data for obesity candidate WVE-007, alongside a recent equity raise intended to fund operations into late 2028.

See our latest analysis for Wave Life Sciences.

Recent trading has been choppy, with a 1 day share price return of 1.85% at a share price of $15.43, following a 30 day share price return decline of 16.68%. However, the 90 day share price return of 88.40% and 1 year total shareholder return of 23.44% indicate that momentum has been building over a longer window as investors react to obesity trial updates, the equity raise and visibility from the upcoming J.P. Morgan Healthcare Conference appearance.

If Wave Life Sciences has caught your attention for obesity and genetic disease research, it could be worth scanning healthcare stocks for other healthcare names pursuing different approaches and risk profiles.

With shares up 88.40% over 90 days but still trading at a sizeable discount to the average analyst price target of US$31.93, you have to ask: is Wave Life Sciences still underappreciated, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 52% Undervalued

With Wave Life Sciences last closing at $15.43 against a narrative fair value of about $31.93, the valuation gap comes down to a handful of aggressive assumptions about future revenue, margins and the obesity and AATD pipelines.

• The upcoming clinical data readouts for key programs (AATD with WVE-006 and obesity with WVE-007) in late 2025 and early 2026 represent potential inflection points, supported by strong early efficacy and favorable safety. If positive, they could significantly expand revenue opportunities in large, underserved markets driven by an aging population and rising chronic disease prevalence.

Want to see what justifies a premium fair value for an unprofitable biotech today? Revenue compounders, thicker margins and a future earnings multiple far above sector norms sit at the core of this narrative. Curious how obesity, AATD and new RNA programs are modeled to support that price? The full breakdown shows which assumptions carry the most weight in getting to $31.93.

Result: Fair Value of $31.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to watch for widening losses and heavy reliance on a few clinical programs, as trial or regulatory setbacks could quickly challenge this upbeat story.

Find out about the key risks to this Wave Life Sciences narrative.

Another View: Price To Sales Sends A Different Signal

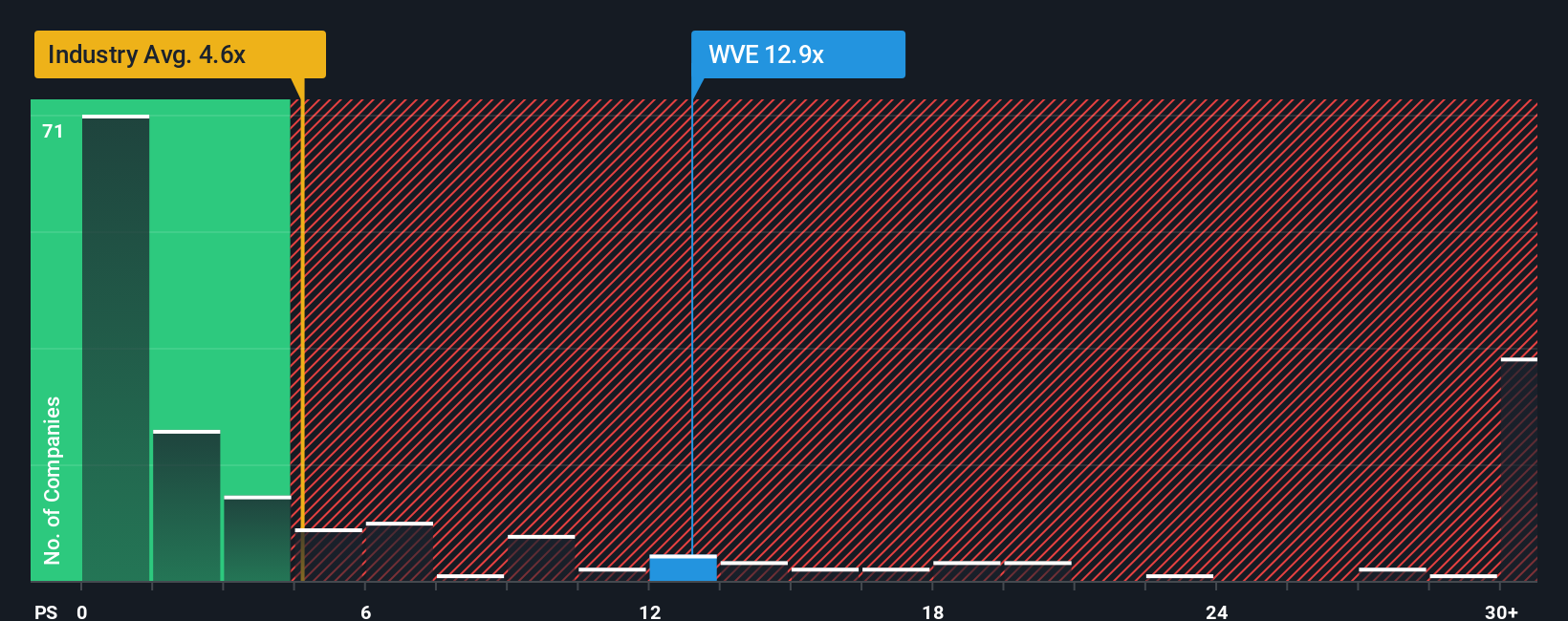

If the narrative fair value of about $31.93 suggests upside, the current P/S ratio tells a more cautious story. Wave Life Sciences trades on a P/S of 25.9x, well above the US Pharmaceuticals industry at 4.2x, its peer average of 13.6x and an estimated fair ratio of 3.1x.

That kind of gap points to meaningful valuation risk if expectations around revenue growth, trial outcomes or future pricing power are not met. With the market already paying such a premium for every dollar of sales, the key consideration is how comfortable you are with that level of optimism.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Wave Life Sciences Narrative

If you are not fully on board with this view or simply prefer to weigh the numbers yourself, you can build a custom narrative in just a few minutes. To get started, use Do it your way.

A great starting point for your Wave Life Sciences research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Wave Life Sciences looks interesting, do not stop there. Broaden your watchlist with other focused ideas that could suit different risk levels and themes.

- Target potential growth stories early by scanning these 3545 penny stocks with strong financials for smaller companies with room to mature if their businesses progress as planned.

- Zero in on income potential by using these 12 dividend stocks with yields > 3% to spot companies offering higher yields that could complement more growth oriented holdings.

- Position yourself for long term trends in digital assets by checking these 79 cryptocurrency and blockchain stocks for businesses building around cryptocurrency and blockchain themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com