Assessing Hershey (HSY) Valuation After The Shaq A Licious SLAMS Nationwide Launch

Why the Shaq-A-Licious SLAMS launch matters for Hershey stock

Hershey (HSY) is back in the spotlight after rolling out Shaq-A-Licious SLAMS nationwide, expanding its co branded gummy line with Shaquille O’Neal into a new, multi textural candy format.

See our latest analysis for Hershey.

At a share price of $180.07, Hershey has had a mixed stretch, with a 6.5% decline in the 90 day share price return even as the 1 year total shareholder return sits at 14.64%. This suggests momentum has cooled after earlier gains, while interest in new products like Shaq A Licious SLAMS keeps the story in focus.

If Shaq A Licious has you thinking about brands with strong followings, it could be a good moment to check out fast growing stocks with high insider ownership for other fast moving ideas.

With Hershey trading at US$180.07 and sitting below some analyst targets despite a solid 1 year total return of 14.64%, you have to ask: is there still upside here, or is the market already pricing in future growth?

Most Popular Narrative: 7.3% Undervalued

With Hershey closing at US$180.07 against a fair value estimate near US$194, the most widely followed narrative sees some valuation support that depends on how earnings and margins evolve from here.

The Fair Value Estimate has risen slightly to about US$194.35 from roughly US$191.95, reflecting a modest uplift in the implied intrinsic value per share.

The Future P/E has ticked up slightly to about 25.94x from roughly 25.85x, indicating a modestly richer multiple applied to projected earnings.

Curious what kind of earnings path could justify that richer future multiple, especially with only modest revenue and margin tweaks in the model? The narrative draws on a defined growth and profitability profile, plus a specific discount rate, to connect today’s price to that higher fair value. The full breakdown shows exactly how those moving parts fit together.

Result: Fair Value of $194.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still clear watchpoints, including high cocoa costs pressuring margins and a weaker consumer backdrop that could test demand for new candy launches.

Find out about the key risks to this Hershey narrative.

Another View: Market Multiple Sends A Different Signal

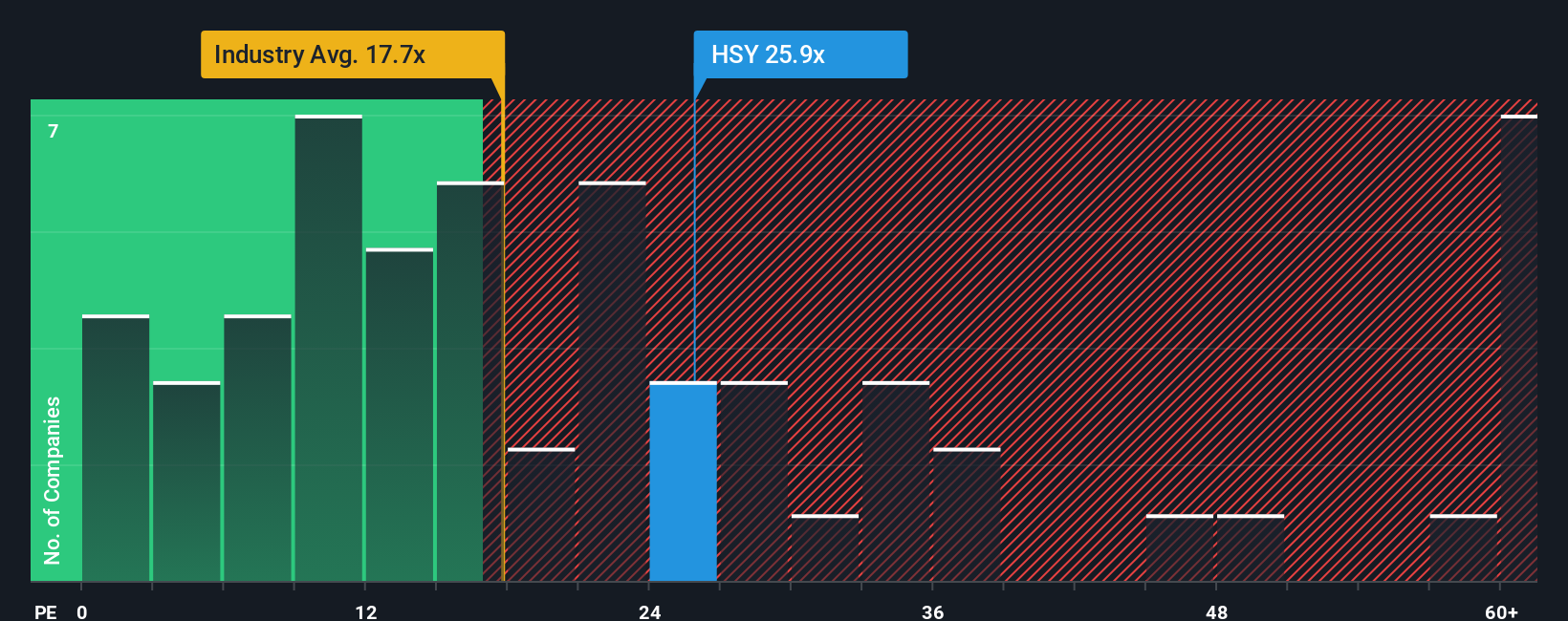

That fair value of about US$194.35 suggests some upside, but the market’s current P/E of 26.9x tells a tougher story. It sits above both the estimated fair ratio of 21.8x and the US Food industry average of 19.9x, as well as above peers at 23.1x. This points to less margin for error if growth or margins disappoint.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Hershey Narrative

If you look at the numbers and come to a different conclusion, or just prefer to test your own assumptions, you can build a personalised view in minutes with Do it your way.

A great starting point for your Hershey research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop your research with Hershey, because the next opportunity that fits your style could already be sitting in a screener ready for you to review.

- Target dependable income by scanning these 12 dividend stocks with yields > 3% that may suit investors who want regular cash flows as part of their total return mix.

- Hunt for growth potential by checking out these 26 AI penny stocks that sit at the intersection of technology and real world problem solving.

- Zero in on value by reviewing these 884 undervalued stocks based on cash flows that appear mispriced based on their projected cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com