Penguin Solutions (PENG) Q1 Profitability Return Tests Bullish AI Growth Narrative

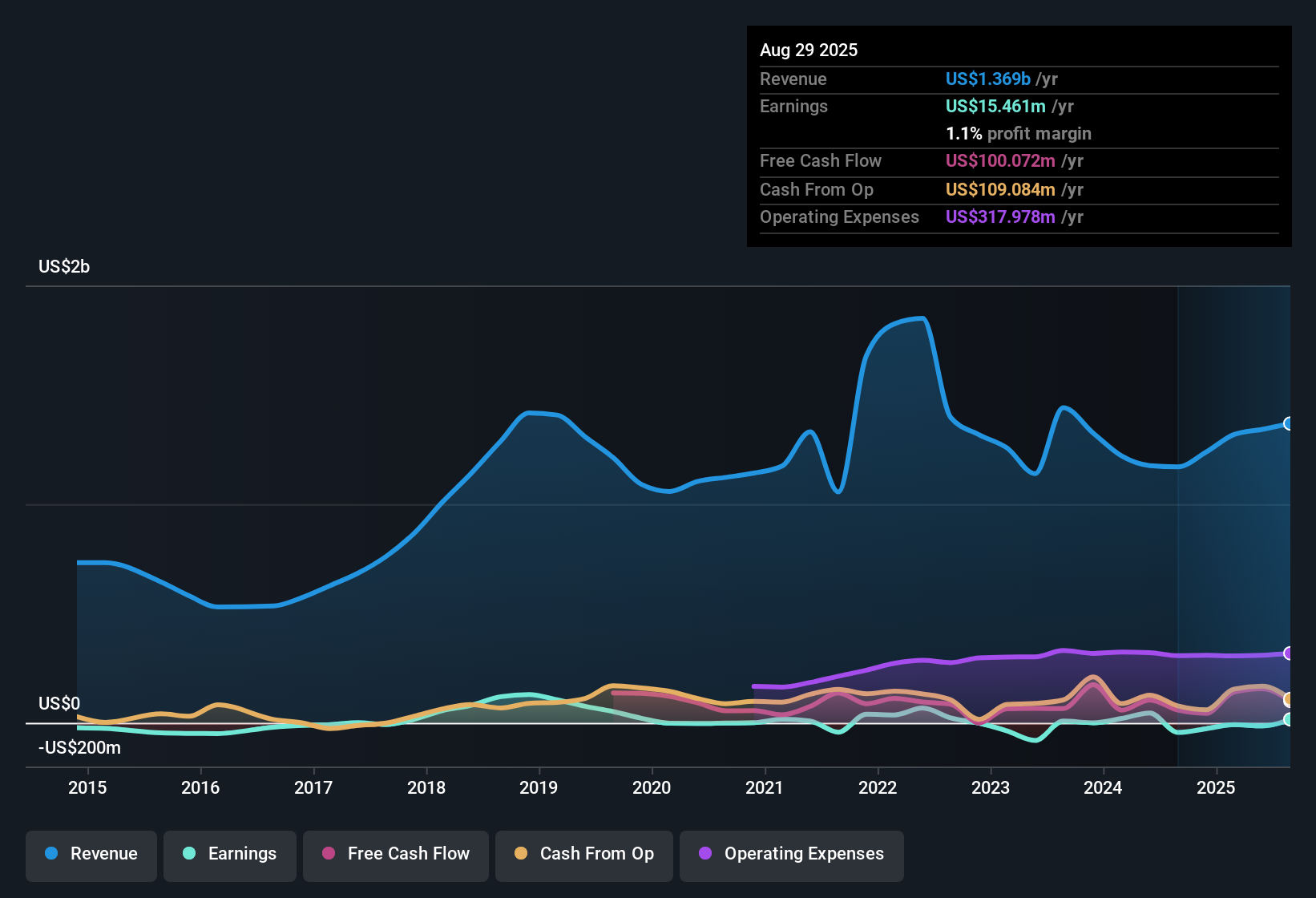

Penguin Solutions (PENG) kicked off Q1 2026 with revenue of US$343.1 million and basic EPS of US$0.04, while the latest trailing twelve month figures show revenue of US$1.37 billion and basic EPS of US$0.24 as the company continues to report positive earnings. Over the past year, revenue has moved from US$1.17 billion in the trailing period to US$1.37 billion, with basic EPS shifting from a loss of US$0.85 to a profit of US$0.24. This development sets the stage for investors to focus closely on how sustainable these margins look after a period that included a large one off loss.

See our full analysis for Penguin Solutions.With the headline numbers on the table, the next step is to see how this return to profitability lines up with the widely followed narratives around Penguin Solutions, and where the latest figures might challenge those stories.

See what the community is saying about Penguin Solutions

TTM profit of US$12.5 million after one off loss

- Over the last twelve months, Penguin Solutions reported net income of US$12.5 million on revenue of US$1.37b, even though that period included a one off loss of US$23.7 million that weighed on the final profit figure.

- Consensus narrative points to AI driven demand and expanding services as long term earnings drivers. However, the inclusion of a US$23.7 million one off loss and a past five year earnings decline of 13.5% a year show that reported profitability has not been a smooth ride.

- The move from a trailing basic EPS loss of US$0.85 to a profit of US$0.24 supports the bullish view that the business can earn money. At the same time, the earlier loss of US$44.3 million in the 2024 Q4 TTM window underlines how sensitive results have been to large items.

- Claims that growing software and services can improve earnings stability sit beside quarterly net income that has ranged from a loss of US$24.5 million in Q4 2024 to a profit of US$5.8 million in Q4 2025, so investors still have to accept meaningful swings in the income line.

Revenue holding near US$343 million per quarter

- Total revenue came in at US$343.1 million in Q1 2026, close to the US$337.9 million to US$365.5 million range seen in the last four quarters, while TTM revenue rose from US$1.17b to US$1.37b alongside modeled revenue growth of about 11% a year.

- Analysts' consensus view links rising AI and high performance computing demand to a stronger sales pipeline. The shift in TTM revenue from US$1.17b to US$1.37b supports the idea that Penguin is handling larger deployments, but the quarterly pattern still reflects lumpiness that critics flag as a risk.

- Bears highlight that big Advanced Computing deals can make revenue timing unpredictable, which lines up with quarterly revenue moving between US$311.1 million and US$365.5 million across the last six reported quarters.

- Supporters point to growing channel partnerships and recurring services, yet the data so far still shows revenue concentrated in a hardware heavy mix, with no separate services line to show how much of the US$343.1 million this quarter is recurring.

P/E of 78.2x with shares at US$18.58

- With the share price at US$18.58 and trailing EPS of US$0.24, Penguin trades on a P/E of 78.2x, higher than the stated US Semiconductor industry average of 41.2x and peer average of 62.6x. The same data set shows a DCF fair value of about US$24.92 and an analyst price target of US$27.63.

- Bulls argue that forecast earnings growth of about 95.7% a year and expected margin expansion justify paying a higher multiple. However, the current 78.2x P/E and history of a five year earnings decline of 13.5% a year give bears plenty to question.

- Supporters will note that the shares sit below the DCF fair value of roughly US$24.92 and below the US$27.63 analyst target, yet that potential upside is tied to ambitious assumptions about profit margins rising from a loss making base to much higher levels.

- Skeptics focus on the combination of a rich P/E and the large US$23.7 million one off loss in the last year, arguing that investors are paying a premium even though recent accounting profits have relied on moving out of loss making territory.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Penguin Solutions on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use the same figures to shape your own view in just a few minutes and put your story on record with Do it your way.

A great starting point for your Penguin Solutions research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Penguin Solutions pairs a high 78.2x P/E and a past five-year earnings decline with uneven quarterly profits that still swing with one-off items and hardware-heavy revenue.

If that mix of rich pricing and bumpy profitability feels uncomfortable, use these 884 undervalued stocks based on cash flows today to focus on companies where current earnings and valuations look more closely aligned.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com