Assessing Expedia Group (EXPE) Valuation After BTIG Flags B2B Momentum And Loyalty Shifts

Expedia Group (EXPE) is back in focus after a recent BTIG research note pointed to stronger room night trends, leaner marketing spend, and the impact of CEO Ariane Gorin’s push toward B2B and revamped loyalty.

See our latest analysis for Expedia Group.

At a share price of $297.18, Expedia Group has seen a 12.39% 30 day share price return and a 37.07% 90 day share price return, while its 1 year total shareholder return of 64.04% suggests momentum has been building around the BTIG flagged focus on room nights, B2B growth, and marketing efficiency.

If this kind of rebound in travel gets you thinking bigger, it could be a good moment to see what else is moving among fast growing stocks with high insider ownership.

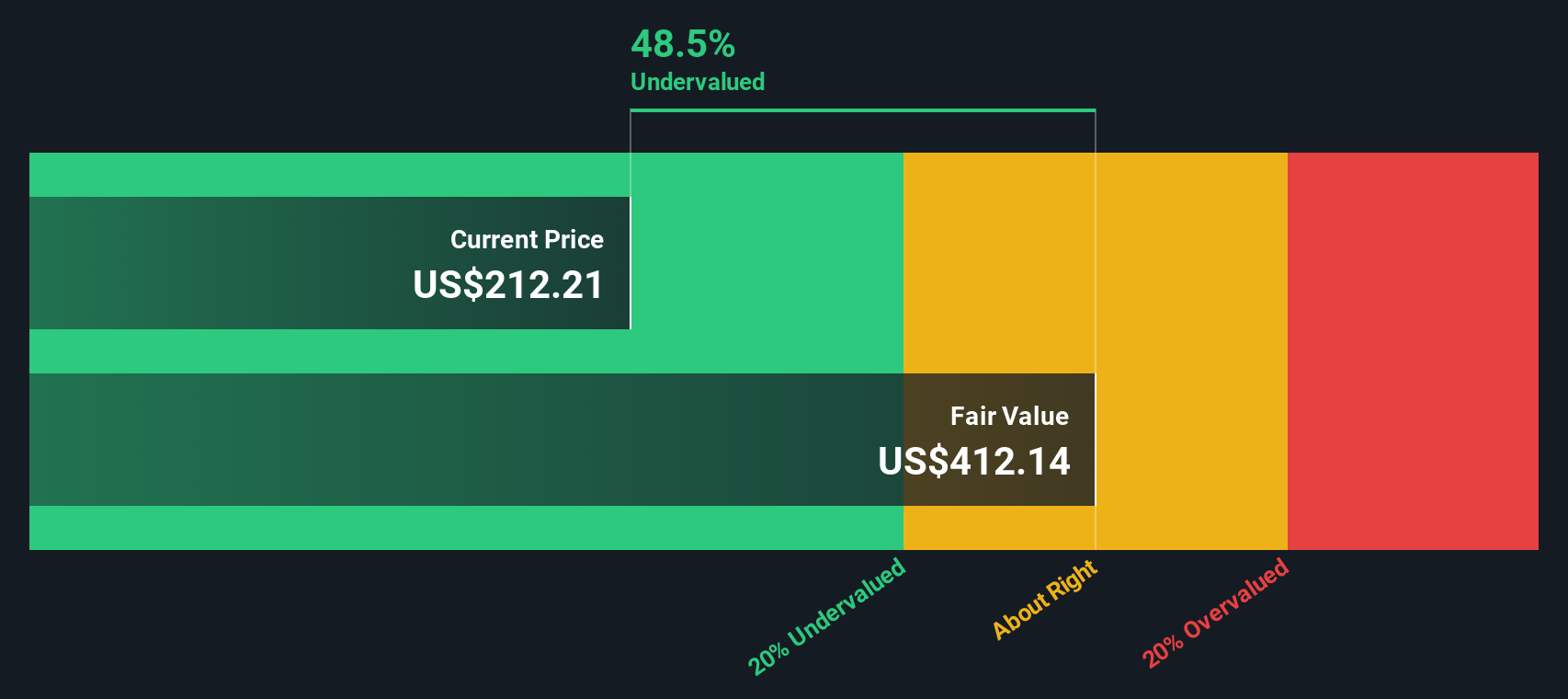

With Expedia Group trading at $297.18, above the average analyst price target yet showing a large intrinsic discount estimate, the key question is whether upside is still on the table or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 9% Overvalued

The most followed narrative sees fair value for Expedia Group at about $273.50 per share, below the recent $297.18 close, which frames its valuation debate clearly.

Strong momentum in B2B and advertising, underpinned by multiple quarters of double-digit revenue growth and new supply partnerships, provides Expedia with high-margin, recurring revenue streams that are less sensitive to cyclical consumer fluctuations. This positively impacts overall net margin stability and earnings durability.

Curious how steady mid single digit revenue growth, rising margins, and a lower future earnings multiple still add up to this valuation? The full narrative lays out the earnings path, the assumed profitability shift, and the price investors might be willing to pay for that profile. The tension between today’s richer multiple and a lower projected one is central to the story.

Result: Fair Value of $273.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still real swing factors here, including pressure on U.S. consumer demand and the risk that AI powered travel tools could reduce take rates and traffic over time.

Find out about the key risks to this Expedia Group narrative.

Another View: DCF Points the Other Way

While the popular narrative tags Expedia Group as about 9% overvalued, our DCF model presents a different perspective, with fair value estimated around $667.14 per share versus the current $297.18 price, suggesting the stock trades at roughly a 55% discount. Which interpretation aligns better with your own assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Expedia Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 884 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Expedia Group Narrative

If you see the assumptions differently or prefer testing the numbers yourself, you can build a fresh Expedia Group story in just a few minutes by starting with Do it your way.

A great starting point for your Expedia Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investing angles?

If Expedia Group has sharpened your thinking, do not stop here. Broaden your watchlist with other focused ideas that could reshape how you allocate your next dollar.

- Target potential mispricings by scanning these 884 undervalued stocks based on cash flows that might not yet be fully appreciated by the market.

- Ride long term themes in automation and data by checking out these 26 AI penny stocks tied to real business use cases.

- Tap into early stage opportunities by reviewing these 3545 penny stocks with strong financials before attention and liquidity move elsewhere.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com