How DRDGOLD’s Tailings-Focused, Cleaner Gold Strategy At DRDGOLD (DRD) Has Changed Its Investment Story

- In recent months, DRDGOLD has attracted renewed attention for its South African operations that reprocess mine tailings for gold, with management reiterating stable production guidance despite short-term volatility.

- What stands out is how DRDGOLD’s high-risk tailings-retreatment model offers leveraged exposure to gold prices while contributing to land rehabilitation and cleaner mining practices.

- We’ll now explore how this focus on tailings retreatment and environmentally cleaner gold production may shape DRDGOLD’s broader investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is DRDGOLD's Investment Narrative?

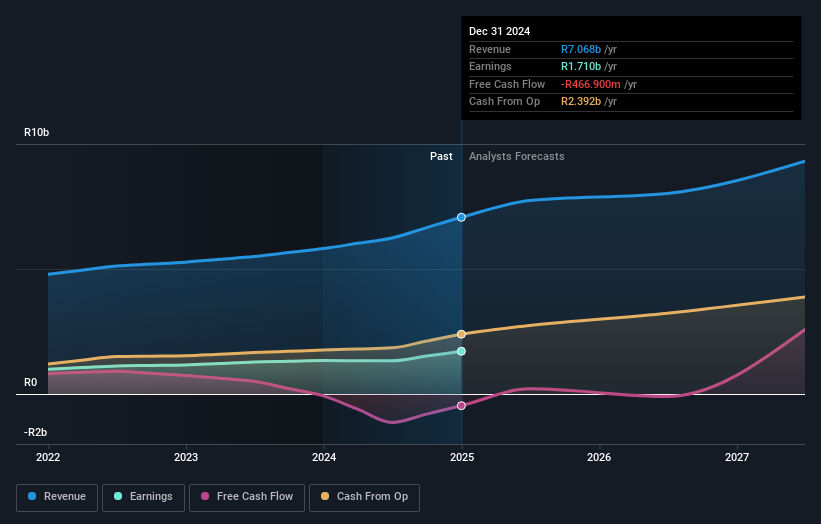

To own DRDGOLD, you have to believe in a niche, high-risk story: that reprocessing tailings in South Africa can keep converting low-grade waste into profitable, cash-generative ounces while supporting land rehabilitation. The recent pullback after a very large one-year total return, together with management’s reaffirmed production guidance, suggests the latest volatility has not fundamentally altered the near-term catalysts, which still hinge on gold prices, stable recovery rates and consistent dividends. At the same time, the news flow underlines that this is a leveraged, speculative exposure where country-specific issues such as power reliability, regulation and executive transitions, including the upcoming CFO handover, remain front of mind. For now, the big picture risk-reward profile looks intact rather than reset by the latest moves.

However, that country and operational risk is something investors should be acutely aware of. DRDGOLD's shares have been on the rise but are still potentially undervalued by 47%. Find out what it's worth.Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span about ZAR11.62 to ZAR74.01 per share, underlining just how far apart individual views can be. Set that against the recent share price pullback and the stock’s sensitivity to South African operating conditions, and you can see why it may pay to weigh several contrasting perspectives before deciding how DRDGOLD fits into your own expectations for gold exposure.

Explore 7 other fair value estimates on DRDGOLD - why the stock might be worth over 2x more than the current price!

Build Your Own DRDGOLD Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DRDGOLD research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free DRDGOLD research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DRDGOLD's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 39 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com