A Look At Vulcan Materials (VMC) Valuation As Infrastructure And Housing Demand Support Long‑Term Growth

Vulcan Materials (VMC) is drawing fresh attention as US infrastructure spending and housing demand continue to support its aggregates, asphalt and concrete business, highlighting its pricing power and long-term contract profile for investors.

See our latest analysis for Vulcan Materials.

At a share price of US$292.12, Vulcan Materials has seen some recent volatility, with a 1-day share price return of 2.58% decline and a softer 90-day share price return of 3.56% decline, while its 1-year total shareholder return of 15.28% and 5-year total shareholder return of 88.19% point to momentum that has, so far, remained constructive over longer periods.

If Vulcan’s steady long-term total shareholder returns interest you, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With Vulcan trading around US$292 and showing steady long term total returns, the key question for you is simple: is there still value left here, or has the market already priced in future growth?

Most Popular Narrative: 8% Undervalued

With Vulcan Materials last closing at US$292.12 versus a narrative fair value of US$317.70, the current pricing sits below that central estimate, which hinges on specific growth, margin and valuation assumptions running out to 2028.

Structural tailwinds from infrastructure resilience and the transition to green/renewable projects are driving long-term demand for aggregates in roads, storm-resistant infrastructure, and energy sites. This enhances Vulcan's long-term volume outlook and supports higher blended pricing, which in turn is expected to lift both top-line revenue and profitability.

Curious how steady volume gains, richer margins and a premium future P/E all fit together in this story? The narrative leans on a detailed path for revenue, profit and valuation multiples that is far from conservative, yet still points to that higher fair value. The interesting part is how much earnings power needs to build by 2028 to make those numbers stack up.

Result: Fair Value of $317.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you also need to weigh the risk that construction activity stays softer for longer, and that weather or funding setbacks slow the timing of expected project work.

Find out about the key risks to this Vulcan Materials narrative.

Another View: Valuation Tension From Earnings Multiples

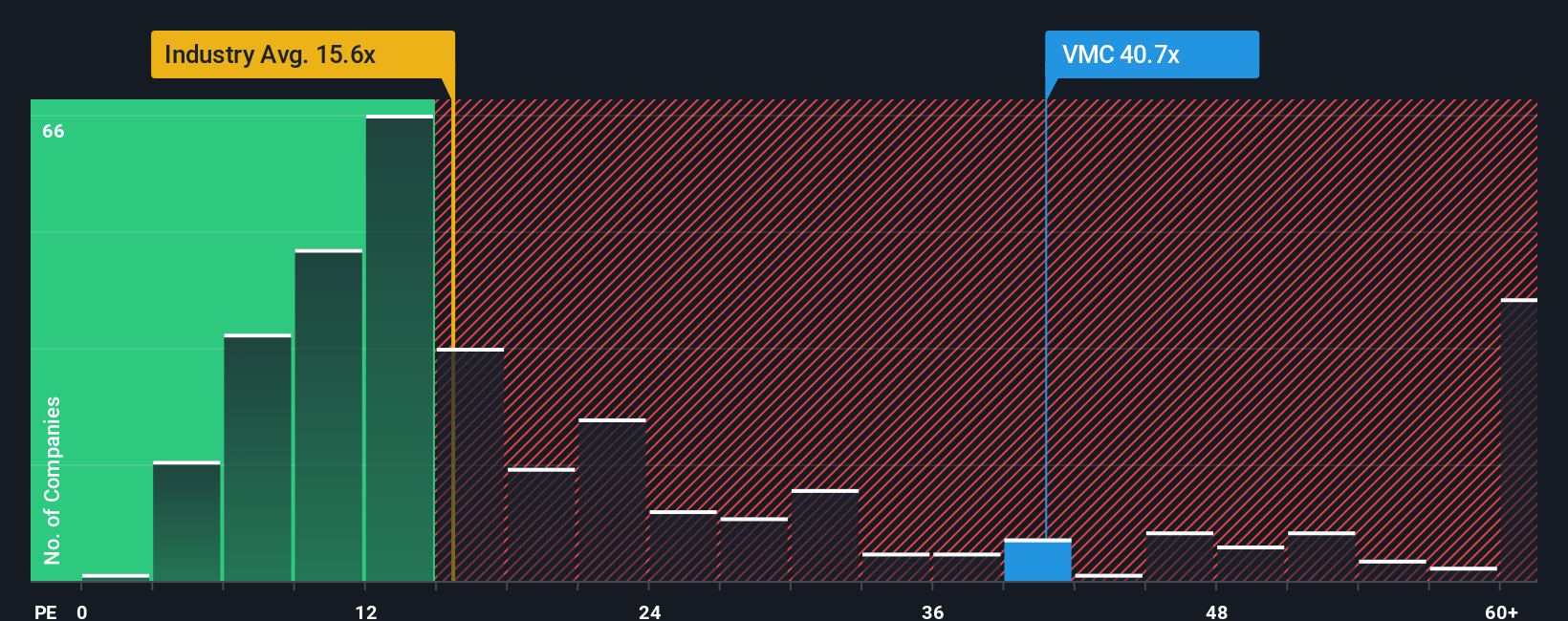

The narrative fair value of US$317.70 suggests upside, but the current P/E of 34.3x sends a very different signal. It sits well above the estimated fair ratio of 23.5x, the global Basic Materials average of 15.4x, and the peer average of 24.9x, which points to meaningful valuation risk if sentiment cools. This raises a key question: is this a quality premium you are comfortable paying, or a signal to be more cautious on price?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vulcan Materials Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a personalised Vulcan Materials view in minutes with Do it your way.

A great starting point for your Vulcan Materials research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Vulcan has you thinking differently about quality and price, do not stop here. Broaden your watchlist and let fresh ideas challenge your current portfolio.

- Spot potential bargains early by scanning these 884 undervalued stocks based on cash flows that screen for opportunities priced below their estimated cash flow value.

- Ride big tech shifts by checking out these 26 AI penny stocks focused on companies applying artificial intelligence across real world products and services.

- Add growth potential with income by reviewing these 12 dividend stocks with yields > 3% that pair shareholder payouts with established business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com