ASX Penny Stocks To Monitor In January 2026

As the Australian market navigates a landscape marked by fluctuating commodity prices and ongoing economic stimuli from China, investors are keenly observing sector movements such as the recent materials sell-off and healthcare gains. In this context, penny stocks—often representing smaller or newer companies—continue to capture interest for their potential to deliver notable returns despite their niche status. While the term may seem outdated, these stocks can still offer promising opportunities when backed by strong financial fundamentals.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Dusk Group (ASX:DSK) | A$0.86 | A$53.55M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.92 | A$448.77M | ✅ 4 ⚠️ 2 View Analysis > |

| MotorCycle Holdings (ASX:MTO) | A$3.08 | A$227.5M | ✅ 4 ⚠️ 1 View Analysis > |

| Pureprofile (ASX:PPL) | A$0.047 | A$54.98M | ✅ 3 ⚠️ 1 View Analysis > |

| Veris (ASX:VRS) | A$0.074 | A$39.99M | ✅ 3 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.27 | A$3.74B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.21 | A$1.35B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.92 | A$132.42M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.26 | A$125.53M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.50 | A$653.48M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 411 stocks from our ASX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Duratec (ASX:DUR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Duratec Limited, with a market cap of A$520.86 million, provides assessment, protection, remediation, and refurbishment services for steel and concrete infrastructure assets in Australia.

Operations: Duratec generates its revenue across several segments, including Energy (A$82.51 million), Defence (A$181.36 million), Buildings & Facades (A$111.87 million), and Mining & Industrial (A$136.65 million).

Market Cap: A$520.86M

Duratec Limited, with a market cap of A$520.86 million, shows financial stability and potential for growth within the penny stock category. The company is not pre-revenue, generating substantial income across sectors like Defence and Mining & Industrial. Recent announcements highlight a strategy focused on diversification through acquisitions and organic growth, supported by a strong cash position exceeding its debt levels. Duratec's earnings have grown significantly over the past five years at 24.3% annually, although recent growth has slowed to 6.5%. Its high return on equity of 30.7% indicates efficient management of shareholder funds while maintaining stable profit margins.

- Click to explore a detailed breakdown of our findings in Duratec's financial health report.

- Gain insights into Duratec's future direction by reviewing our growth report.

Tyro Payments (ASX:TYR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tyro Payments Limited offers integrated payment solutions and value-added services in Australia, with a market cap of A$550.34 million.

Operations: The company's revenue is primarily derived from its Payments segment, which generated A$460.86 million, complemented by its Banking segment with A$14.78 million.

Market Cap: A$550.34M

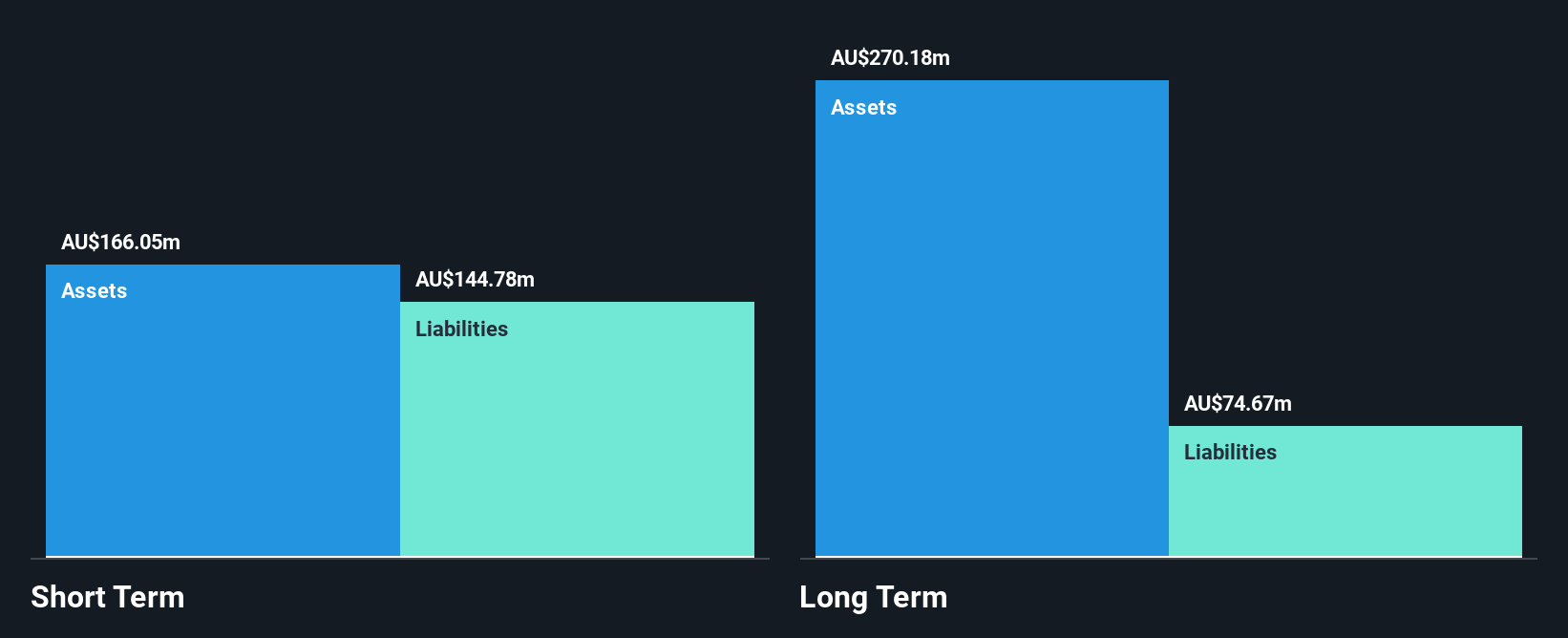

Tyro Payments Limited, with a market cap of A$550.34 million, stands out in the penny stock landscape due to its integrated payment solutions and stable financial position. Despite recent negative earnings growth and low return on equity at 7.9%, Tyro remains debt-free, supported by strong short-term assets exceeding liabilities. The company has achieved profitability over five years with high-quality earnings but faces challenges with declining profit margins from 5.5% to 3.7%. Recent executive changes include the transition of CEO leadership from Jon Davey to Nigel Lee, potentially impacting strategic direction moving forward.

- Click here to discover the nuances of Tyro Payments with our detailed analytical financial health report.

- Gain insights into Tyro Payments' outlook and expected performance with our report on the company's earnings estimates.

Winsome Resources (ASX:WR1)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Winsome Resources Limited, along with its subsidiaries, focuses on exploring and developing lithium properties in Canada and has a market capitalization of A$128.08 million.

Operations: Winsome Resources Limited has not reported any revenue segments.

Market Cap: A$128.08M

Winsome Resources Limited, with a market cap of A$128.08 million, is pre-revenue and operates debt-free, which can be appealing for risk-tolerant investors interested in penny stocks. The company's short-term assets significantly exceed both its short- and long-term liabilities, indicating solid financial management despite its unprofitability. However, the cash runway is less than a year under current conditions. Recent developments include an acquisition agreement by Li-FT Power Ltd., valuing Winsome at approximately A$130.8 million; if completed by late April 2026, existing Winsome securityholders will own about 35.3% of the combined entity.

- Dive into the specifics of Winsome Resources here with our thorough balance sheet health report.

- Gain insights into Winsome Resources' past trends and performance with our report on the company's historical track record.

Make It Happen

- Jump into our full catalog of 411 ASX Penny Stocks here.

- Want To Explore Some Alternatives? Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com