A Look At Agnico Eagle Mines (NYSE:AEM) Valuation As Earnings Outlook And Strong Buy Rating Improve

Agnico Eagle Mines (NYSE:AEM) is back in focus after analysts projected year-over-year earnings growth of 59.52% and revenue growth of 35.01% for its upcoming report, alongside a Zacks Rank of #1 (Strong Buy).

See our latest analysis for Agnico Eagle Mines.

The recent move to a share price of $182.07, alongside a 10.53% 1 month share price return and 12.58% 3 month share price return, sits against a very large 1 year total shareholder return of 121.20%, indicating that momentum has been building as expectations for earnings have shifted.

If strong earnings expectations in gold are on your radar, it could be a useful moment to broaden your view with fast growing stocks with high insider ownership.

With the shares now around $182.07 and trading at a discount of about 8% to the average analyst price target, the key question is whether Agnico Eagle Mines is still mispriced or if the market already reflects the projected growth.

Most Popular Narrative: 7.6% Undervalued

The most followed narrative puts Agnico Eagle Mines' fair value at about $197.08 per share versus the last close of $182.07, framing the current setup as a modest discount.

Exploration success and rapid reserve expansion near key long-life assets (notably Detour Lake, Canadian Malartic, and Hope Bay) position Agnico Eagle for significant organic production growth; this supports a long runway of high-quality, low-risk volume expansion that can drive top-line revenue growth and production leverage.

Curious how steady revenue growth, slightly higher margins, and a premium future earnings multiple combine to reach that fair value? The full narrative walks through the exact earnings path, the assumed production lift around key mines, and the valuation multiple needed to make the math work.

Result: Fair Value of $197.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside story could crack if gold prices settle materially lower, or if key projects like Detour underground or San Nicolas face delays or cost overruns.

Find out about the key risks to this Agnico Eagle Mines narrative.

Another View: DCF Flags A Different Story

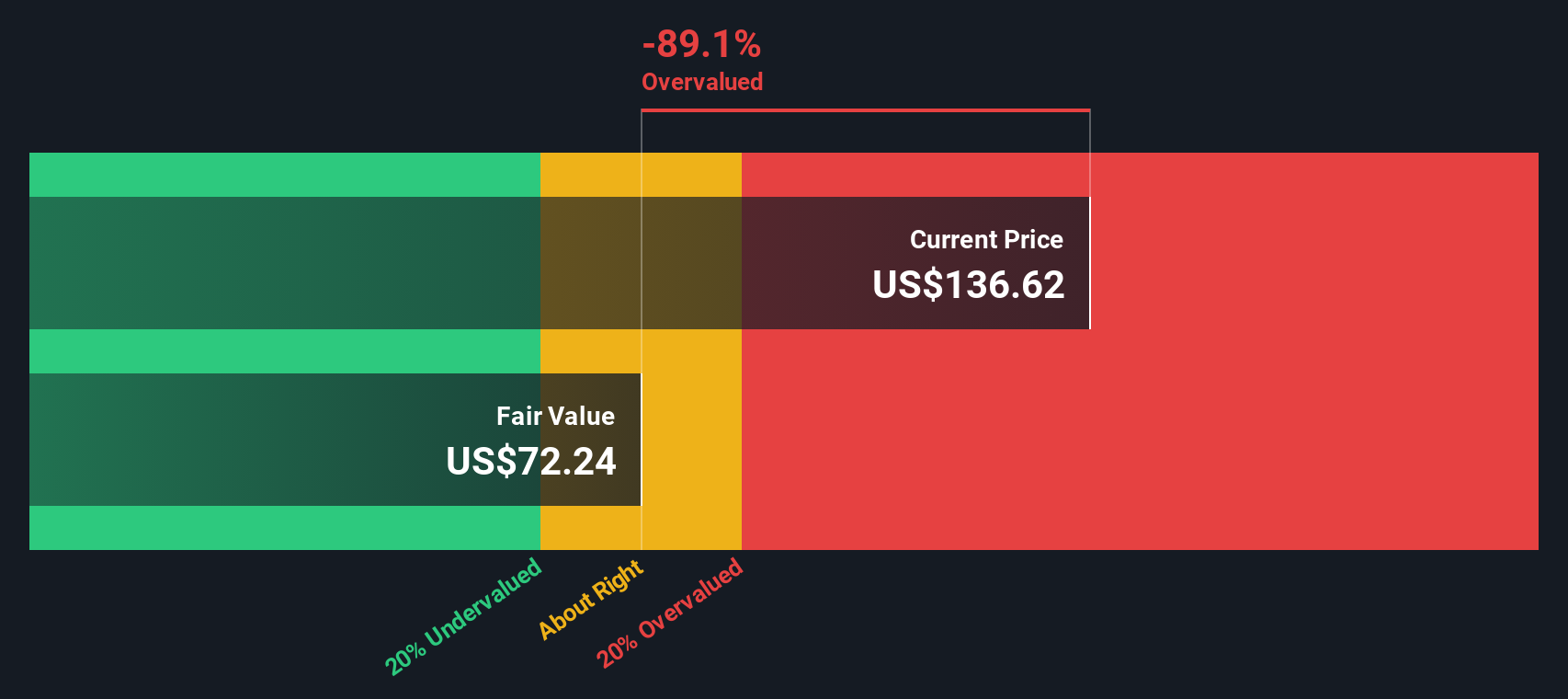

While the consensus narrative leans on earnings and multiples, the Simply Wall St DCF model points the other way. On that view, Agnico Eagle Mines at $182.07 sits well above an estimated fair value of $106.38, which frames the stock as expensive rather than modestly undervalued. Which lens do you trust more when real money is on the line?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Agnico Eagle Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Agnico Eagle Mines Narrative

If you see the setup differently or prefer to test your own assumptions against the numbers, you can build a complete thesis in minutes with Do it your way.

A great starting point for your Agnico Eagle Mines research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop here, you only see one part of the opportunity set; broaden your watchlist now and let the data point you to fresh ideas.

- Target income-focused opportunities by scanning these 12 dividend stocks with yields > 3% that might complement or balance a gold producer such as Agnico Eagle Mines.

- Explore the potential of digital assets by researching these 79 cryptocurrency and blockchain stocks that link traditional markets with blockchain and payment technologies.

- Stay informed on sector developments by checking these 29 healthcare AI stocks where data, software, and medicine intersect in compelling ways.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com