Assessing Krystal Biotech (KRYS) Valuation As Investors Await CORAL-1 KB407 Interim Cystic Fibrosis Data

Krystal Biotech (KRYS) is back in focus after the company scheduled a January 8 investor call to share interim data from the highest dose cohort of its Phase 1 CORAL-1 cystic fibrosis study of KB407.

See our latest analysis for Krystal Biotech.

Krystal Biotech’s recent product news and conference appearances come against a backdrop of a US$246.37 share price, a 30.52% 3 month share price return and a 57.25% 1 year total shareholder return. This suggests momentum has been building as investors reassess growth potential and risks around its genetic medicines pipeline.

If KB407 has caught your attention, this could be a good moment to broaden your watchlist to other healthcare stocks that are gaining interest with new clinical and commercial updates.

With Krystal Biotech trading around US$246.37 after a 30.52% 3 month return and a 57.25% 1 year total shareholder return, the key question now is whether the current price still reflects an opportunity or if markets are already pricing in future growth.

Most Popular Narrative Narrative: 10.5% Overvalued

With Krystal Biotech last closing at US$246.37 against a narrative fair value of US$223, the current setup hinges on how future earnings and margins play out.

The analysts have a consensus price target of $205.2 for Krystal Biotech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $252.0, and the most bearish reporting a price target of just $166.0.

Curious what kind of revenue ramp, margin expansion and future P/E multiple have to line up for that fair value to make sense? The full narrative spells out the growth path, the profitability profile and the valuation math that keep this story hanging on a tight set of assumptions.

Result: Fair Value of $223 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could shift quickly if VYJUVEK revenue proves more uneven than expected, or if reimbursement decisions in Europe and Japan turn out less favorable.

Find out about the key risks to this Krystal Biotech narrative.

Another View: DCF Points the Other Way

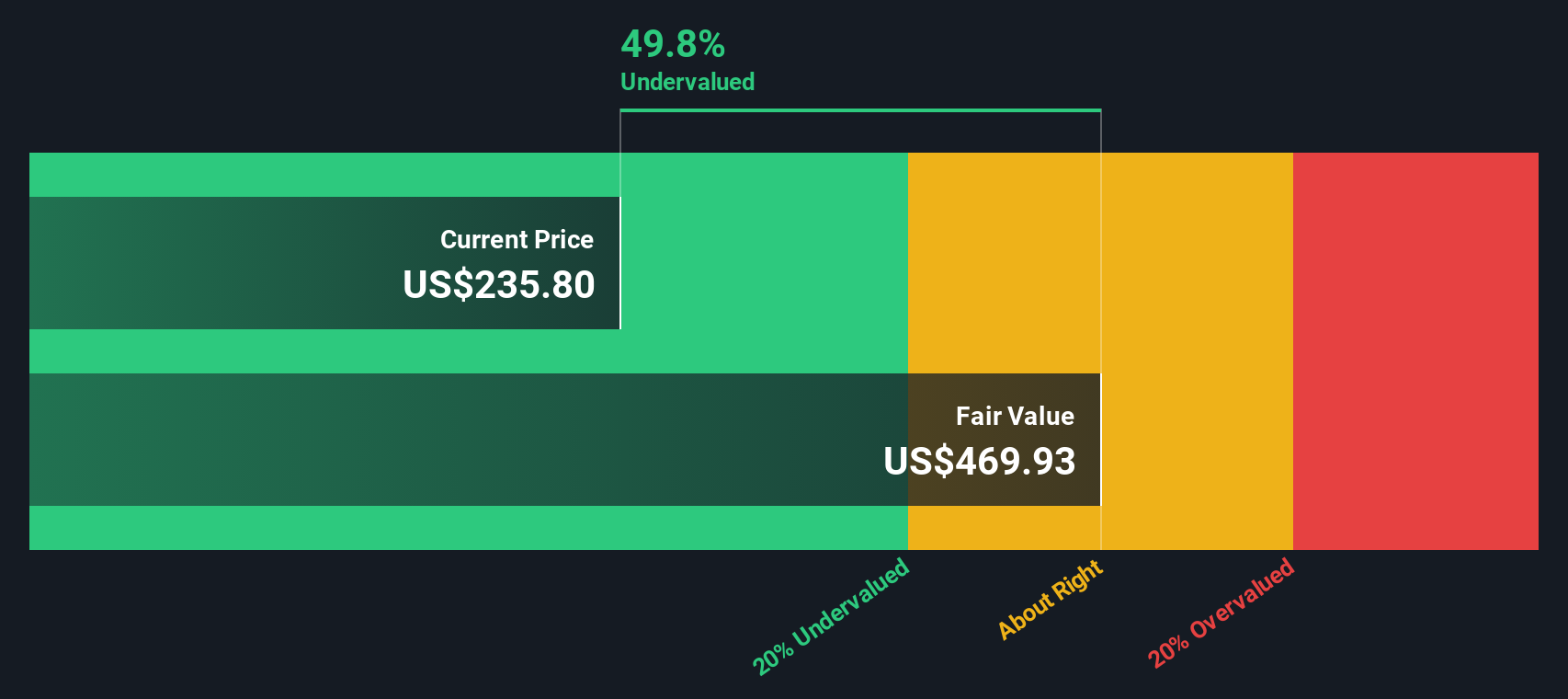

While the narrative fair value of US$223 flags Krystal Biotech as about 10.5% overvalued, the SWS DCF model lands in a very different place. With an estimate of US$516.84 per share, the stock screen shows it trading about 52.3% below that level. This raises an obvious question: which story do you think is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Krystal Biotech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Krystal Biotech Narrative

If you are not fully on board with these assumptions or prefer to test the numbers yourself, you can build and refine your own view in minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Krystal Biotech.

Ready to hunt for your next idea?

If Krystal Biotech is on your radar, this can be a smart time to widen the net and scan for other setups that fit what you are looking for.

- Target value-focused opportunities by checking out these 882 undervalued stocks based on cash flows that might align more closely with the price and quality mix you want.

- Spot early-stage potential by reviewing these 3543 penny stocks with strong financials that meet your risk tolerance and fundamental preferences.

- Position yourself in fast-moving themes by scanning these 79 cryptocurrency and blockchain stocks tied to digital assets and blockchain use cases you understand.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com