Will Santander’s UK Mortgage Repricing Toward Higher LTVs Change Banco Santander's (BME:SAN) Narrative

- In recent weeks, Banco Santander withdrew certain 60% loan-to-value UK mortgage products for first-time buyers borrowing under £250,000, as part of a broader repricing after the Bank of England held rates and markets signalled limited further mortgage rate falls.

- The shift highlights how Santander is prioritizing higher loan-to-value segments, offering first-time buyers 85% and above LTV deals starting around 4.06% for two-year fixes and 4.19% for five-year terms, which may reshape its UK mortgage mix and risk profile.

- We’ll now examine how Santander’s move toward higher loan-to-value UK mortgages could influence its broader earnings, risk profile, and investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Banco Santander Investment Narrative Recap

To own Santander, you need to believe in its diversified European and Latin American retail and commercial banking model, with earnings supported by deposit funding, payments and fee income. The recent UK mortgage repricing looks incremental rather than transformative, but it does touch on a key short term catalyst: how effectively Santander balances margin protection with loan growth without materially increasing its cost of risk, particularly given existing pressures in some core markets.

Recent capital management actions, including multiple senior non preferred debt tenders and the early redemption of CoCo securities in early 2025, are more consequential for the near term story than this specific UK mortgage tweak. They speak directly to the group’s current focus on capital efficiency and funding costs, which sit alongside technology investment and loan quality in shaping how much earnings ultimately reach shareholders.

Yet investors should also be aware that rising bad loans and a relatively low allowance for those loans could...

Read the full narrative on Banco Santander (it's free!)

Banco Santander's narrative projects €63.8 billion revenue and €13.2 billion earnings by 2028. This requires 8.4% yearly revenue growth and about a €0.6 billion earnings increase from €12.6 billion today.

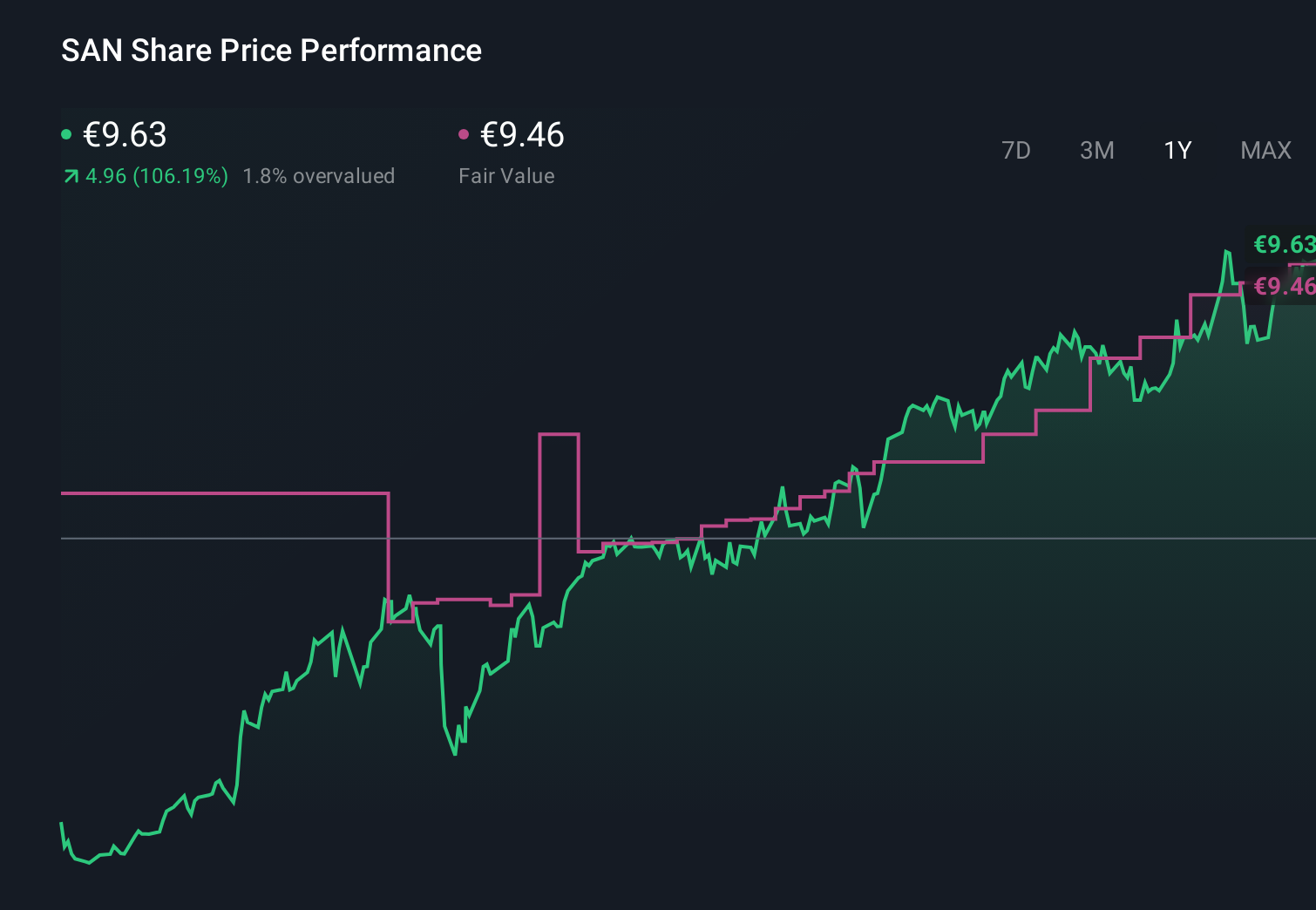

Uncover how Banco Santander's forecasts yield a €9.53 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have produced 11 fair value estimates for Santander, ranging from €6.14 to €12.64 per share. You can weigh those views against concerns about elevated bad loans in some key markets and consider how that might affect the bank’s ability to keep growing earnings and protecting its capital base over time.

Explore 11 other fair value estimates on Banco Santander - why the stock might be worth 40% less than the current price!

Build Your Own Banco Santander Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Banco Santander research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Banco Santander's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com