Does HCA’s Florida ER and NICU Expansion Deepen Its Sun Belt Growth Story For HCA (HCA)?

- HCA Florida Healthcare has recently expanded its footprint in Florida, opening new freestanding emergency rooms around Jacksonville and nearing completion of a larger NICU and maternity expansion at HCA Florida St. Lucie Hospital, while continuing to highlight family-focused care at facilities like HCA Florida Lawnwood Hospital.

- Together, these facility investments and service enhancements point to a broader effort by HCA Healthcare to deepen its presence in high-growth Sun Belt communities and broaden access to acute and neonatal care.

- Next, we’ll explore how HCA’s expansion of Florida emergency and NICU capacity may influence its investment narrative and long-term outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

HCA Healthcare Investment Narrative Recap

To own HCA Healthcare, you have to be comfortable with a large, capital-intensive hospital operator that is leaning into volume growth, operating efficiency and disciplined expansion in fast-growing markets. The latest Florida openings and NICU buildouts support the volume and capacity story, but they do not materially change the nearer term focus on managing labor costs or the ongoing risk from shifting federal and state reimbursement rules.

Among recent announcements, Mizuho’s updated US$520 price target and comments on HCA’s margins and utilization tie most closely to this Florida expansion, since higher emergency and NICU capacity directly links to admissions and revenue per equivalent admission. The firm’s emphasis on disciplined growth spending also frames these Florida projects as part of a measured capacity build rather than a sudden change in HCA’s overall capital allocation priorities.

Yet even as HCA grows its Florida footprint, investors still need to keep a close eye on evolving federal policy and reimbursement risk...

Read the full narrative on HCA Healthcare (it's free!)

HCA Healthcare's narrative projects $85.4 billion revenue and $6.9 billion earnings by 2028. This requires 5.5% yearly revenue growth and about $0.9 billion earnings increase from $6.0 billion today.

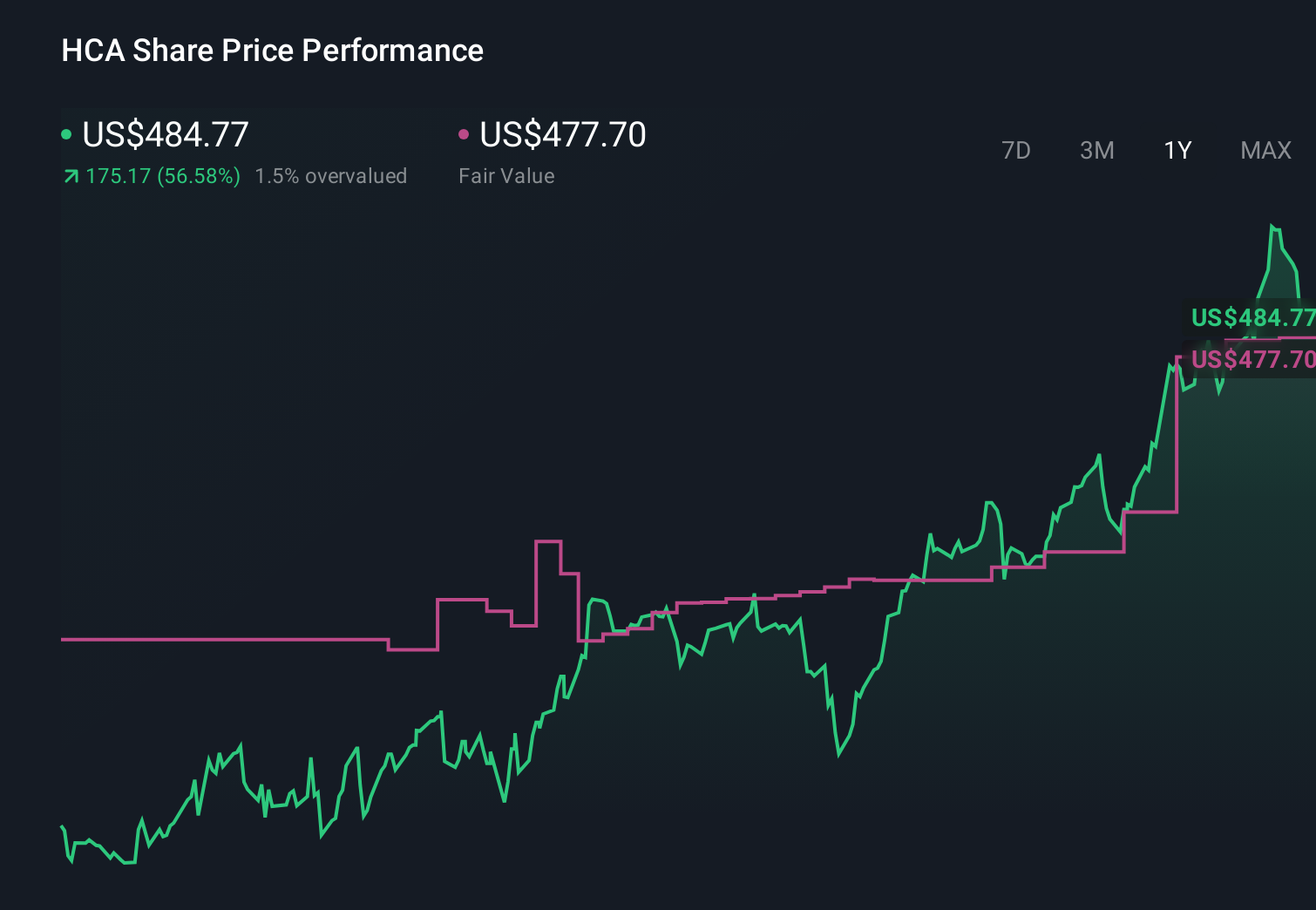

Uncover how HCA Healthcare's forecasts yield a $481.95 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value HCA between about US$369 and US$900 per share, reflecting very different growth expectations. Against this wide spread, HCA’s push to expand capacity while keeping operating margins in check raises important questions about how sustainably it can offset reimbursement and cost pressures over time, so it is worth comparing several of these independent views before forming your own stance.

Explore 5 other fair value estimates on HCA Healthcare - why the stock might be worth 22% less than the current price!

Build Your Own HCA Healthcare Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free HCA Healthcare research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HCA Healthcare's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com