A Look At BlackSky Technology (BKSY) Valuation After Rapid Gen 3 Satellite Commercial Rollout

Gen 3 satellites bring BlackSky’s latest tech shift into focus

BlackSky Technology (BKSY) has quickly brought its Gen 3 satellites into full commercial operation within 21 days, a recent development that is drawing attention to the stock’s role in real time geospatial intelligence.

The new satellites are reported to increase imagery capacity and cut latency, while the company’s AI powered Spectra analytics platform aims to turn that data into timely intelligence for government and commercial clients, including defense users.

See our latest analysis for BlackSky Technology.

Gen 3’s rapid rollout has arrived alongside a 29.39% 7 day share price return and a 32.71% 30 day share price return. The 1 year total shareholder return of 139.49% contrasts with a 71.91% total shareholder loss over five years, suggesting momentum has recently picked up after a tougher longer term stretch.

If real time space data has your attention, it could be a good moment to see what else is on the move among aerospace and defense stocks.

With BlackSky’s shares up sharply in the short term, an intrinsic discount of about 68% and a value score of 2, you have to ask: is the stock still misunderstood, or are markets already pricing in future growth?

Most Popular Narrative: 11.1% Undervalued

BlackSky Technology’s most widely followed narrative points to a fair value of US$27.29 per share, compared with the last close at US$24.26. This anchors a modest discount that rests on some confident growth and margin assumptions.

The analysts have a consensus price target of $24.375 for BlackSky Technology based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.0 and the most bearish reporting a price target of $17.0.

Want to see what is baked into that fair value? Revenue expansion, margin turnaround and a premium future earnings multiple all sit at the core. Curious which assumptions really move the needle here? The full narrative lays out the numbers and the discount rate that hold this valuation together.

Result: Fair Value of $27.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this story can change quickly if Gen 3 trials do not convert into longer contracts, or if heavier spending and funding needs lead to more dilution.

Find out about the key risks to this BlackSky Technology narrative.

Another View: Rich Sales Multiple Keeps Expectations High

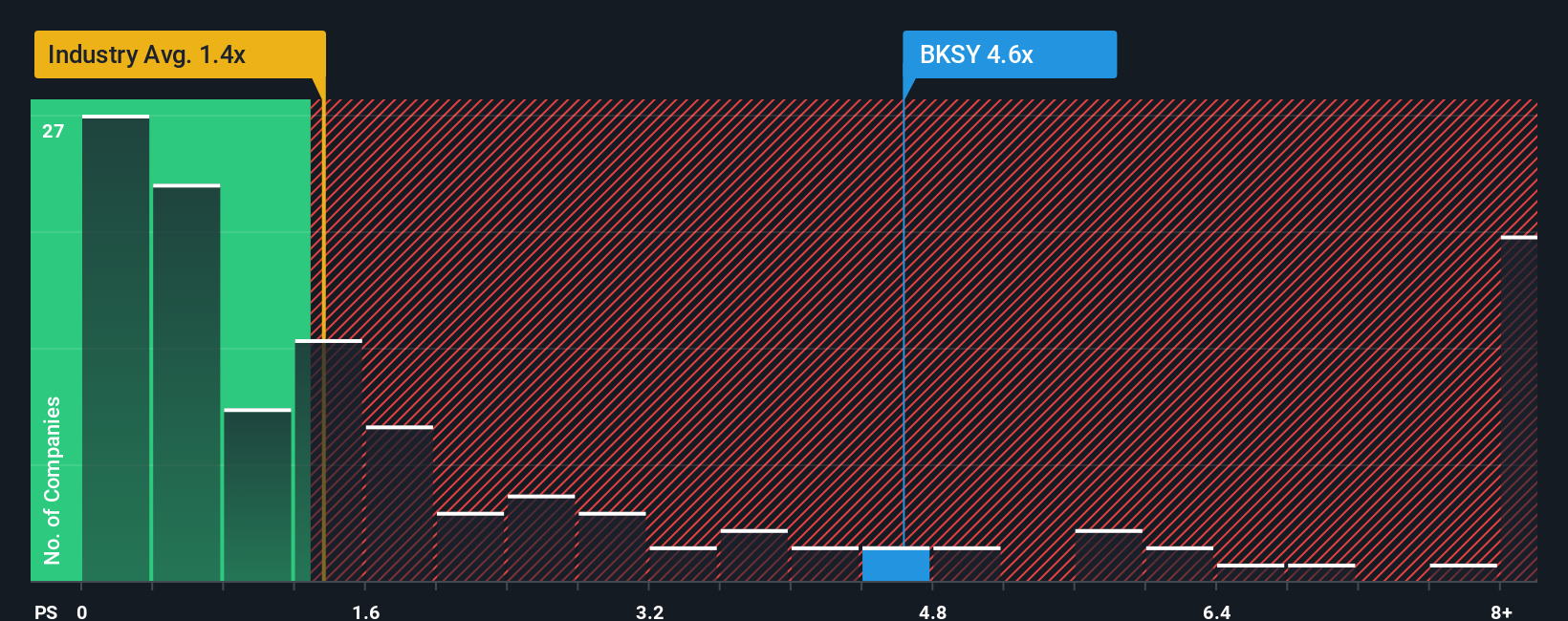

The fair value narrative leans on future revenue and margin gains, but today BlackSky trades on a P/S of 8.5x, compared with 1.3x for the US Professional Services industry, 1.5x for peers and a fair ratio of 3.4x. That gap suggests high expectations. How comfortable are you paying up for this story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BlackSky Technology Narrative

If your view of BlackSky’s future looks different, or you simply prefer to test the inputs yourself, you can build a custom narrative in just a few minutes. To get started, use Do it your way.

A great starting point for your BlackSky Technology research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If BlackSky has sparked your interest, do not stop here. A few minutes with the right screeners can surface companies you might wish you had found earlier.

- Spot potential value opportunities early by scanning these 883 undervalued stocks based on cash flows that currently trade below their estimated worth based on cash flows.

- Ride the next wave of automation by checking out these 27 AI penny stocks that are shaping real world applications of artificial intelligence.

- Target higher income potential by reviewing these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com