Assessing Alamos Gold (TSX:AGI) Valuation As Options Volatility And Bullish Gold Outlook Draw Focus

Options volatility puts Alamos Gold in focus

Alamos Gold (TSX:AGI) is back on traders’ radar as options activity signals expectations for a sizeable move in the share price, and CEO John McCluskey’s recent gold commentary adds another layer for investors to consider.

See our latest analysis for Alamos Gold.

Options volatility is arriving on top of strong recent momentum, with the share price at CA$57.01 after a 1-month share price return of 15.94% and a 1-year total shareholder return above 100%. This suggests sentiment has been improving rather than fading.

If activity in gold names has caught your attention, it could be worth widening your watchlist to see how other materials and mining peers compare with fast growing stocks with high insider ownership.

With implied volatility elevated and Alamos trading at CA$57.01 against an analyst price target of CA$65.21, the key question is: are you looking at an undervalued gold producer or a stock already pricing in future growth?

Most Popular Narrative Narrative: 12.3% Undervalued

With Alamos Gold closing at CA$57.01 against a narrative fair value of CA$64.98, the current setup leans toward upside in that framework.

Significant organic production growth is underway, with ongoing ramp-up at Magino and the Island Gold Phase 3+ expansion projected to raise consolidated output toward a range of 900,000 to 1,000,000 ounces per year over the next several years, supporting strong top-line growth and free cash flow.

Want to see what underpins that higher fair value? Revenue climbing at a healthy clip. Margins moving higher. A future earnings base that assumes much richer profitability. Curious how those ingredients stack together to reach that valuation target?

Result: Fair Value of CA$64.98 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on big projects and gold prices holding up. Delays at Island Gold or Magino, or softer gold, could quickly challenge that upside story.

Find out about the key risks to this Alamos Gold narrative.

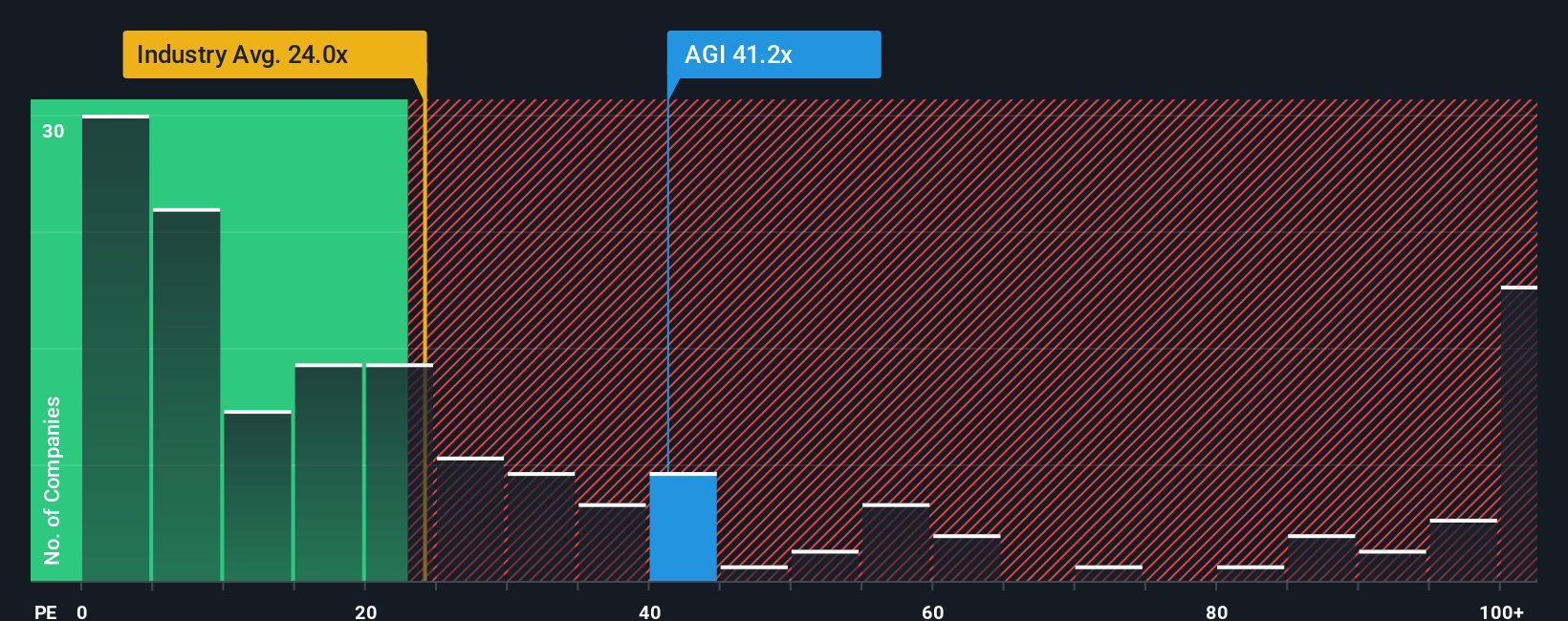

Another View: Multiples Tell a Different Story

That 12.3% discount to narrative fair value sounds appealing, but the market is not giving Alamos away. At a P/E of 32.1x, the shares trade richer than the Canadian Metals and Mining industry at 23.4x and above a fair ratio of 25.9x. That kind of premium can cut both ways if expectations change. Is the extra price something you are comfortable paying?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Alamos Gold Narrative

If parts of this story do not quite fit your view, or you prefer to work from the raw numbers yourself, you can build a tailored thesis in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alamos Gold.

Looking for more investment ideas?

If you are serious about sharpening your watchlist, do not stop at one gold name. Broaden your search and pressure test your next moves with targeted screeners.

- Spot under-the-radar value by checking these 883 undervalued stocks based on cash flows, which currently price in more modest expectations than their cash flows might suggest.

- Ride major tech shifts by scanning these 27 AI penny stocks, which tie artificial intelligence themes to listed companies across different sectors.

- Tap into early stage opportunities with these 3543 penny stocks with strong financials, which combine smaller market caps with filters for stronger fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com