Assessing Taysha Gene Therapies (TSHA) Valuation After REVEAL Trial Progress And FDA Alignment On TSHA-102

Taysha Gene Therapies (TSHA) drew fresh attention after dosing the first patient in its REVEAL pivotal trial for TSHA-102 in Rett syndrome and securing FDA alignment on safety data for its planned BLA submission.

See our latest analysis for Taysha Gene Therapies.

Against this backdrop, Taysha Gene Therapies’ share price sits at US$5.31, with a 90 day share price return of 6.2% and a 1 year total shareholder return above 170%. This indicates that momentum has been building despite some recent short term pullbacks.

If you are watching how gene therapy headlines move stocks, it may also be a good time to scan other healthcare stocks that could be setting up for their next catalyst.

With TSHA trading at US$5.31, a value score of 3 and an indicated discount to both analyst targets and intrinsic value, you have to ask: is this still misunderstood, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 50.8% Undervalued

With Taysha Gene Therapies closing at US$5.31 and the most followed narrative pointing to fair value around US$10.79, the gap between price and narrative is wide enough to get attention.

The analysts have a consensus price target of $6.55 for Taysha Gene Therapies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.0.

Curious what sits behind that higher fair value and wide price target spread? Revenue ramp, margin reset and a premium future earnings multiple all sit at the core of this narrative. Want to see how those ingredients are stitched together into a single valuation story?

Result: Fair Value of $10.79 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh the risk that regulatory timelines slip, or that costly trials and ongoing net losses keep the story on a much longer runway.

Find out about the key risks to this Taysha Gene Therapies narrative.

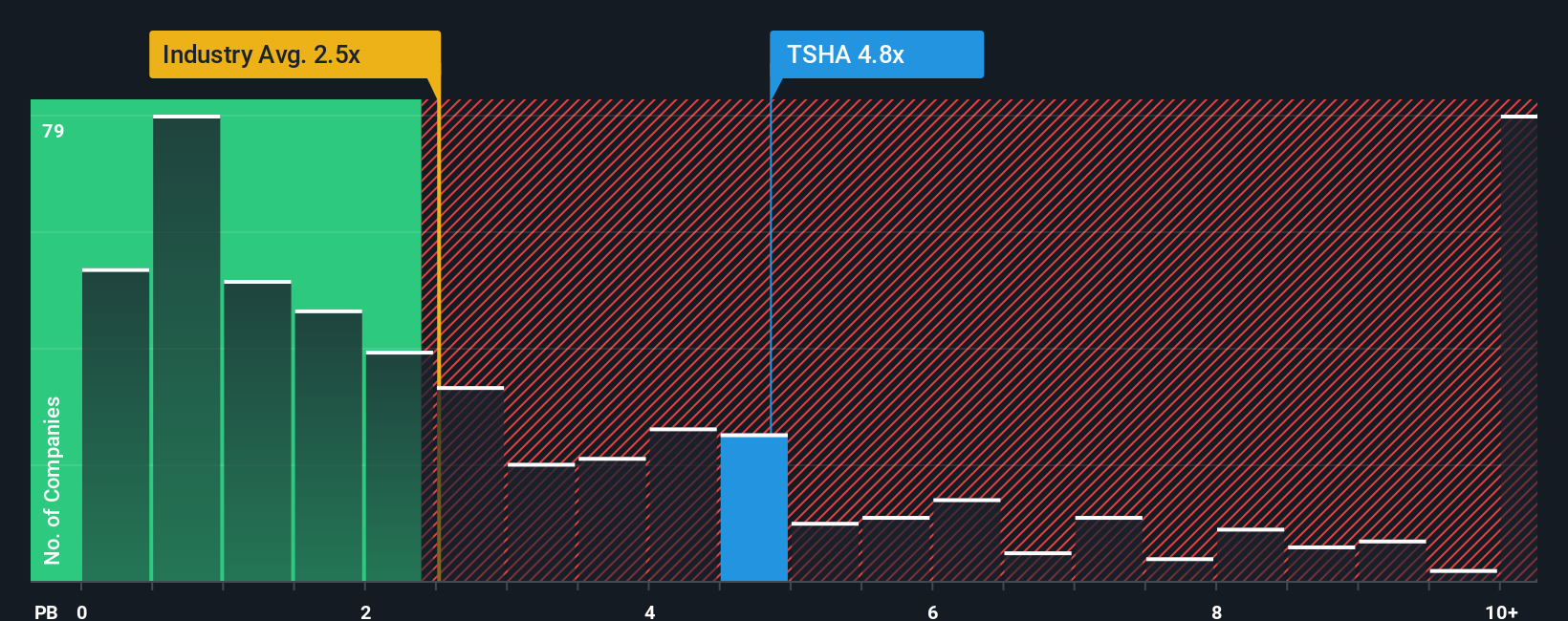

Another View: Price To Book Sends A Different Signal

While the narrative fair value of US$10.79 suggests a large upside gap, the current P/B ratio of 6.6x paints a different picture. It is higher than the 2.7x average for US biotech, yet below the 11.6x peer average, so the market signal here is mixed rather than clearly cheap or expensive.

Put simply, you are looking at a stock that screens expensive against the broader industry, but cheaper than closer peers. This raises a straightforward question: are you more focused on the wider sector benchmark or the smaller peer group when you judge risk and room for rerating?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Taysha Gene Therapies Narrative

If parts of this story do not quite fit your view, or you prefer to test the numbers yourself, you can shape your own full Taysha Gene Therapies narrative in just a few minutes by starting with Do it your way

A great starting point for your Taysha Gene Therapies research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Taysha Gene Therapies is on your radar, it makes sense to line it up against other focused ideas so you are not relying on a single story.

- Target potential mispricings by scanning these 883 undervalued stocks based on cash flows that may offer attractive entry points based on their fundamentals and current market pricing.

- Ride major tech shifts by checking out these 27 AI penny stocks that are tying artificial intelligence to real business models and revenue streams.

- Strengthen your income watchlist by reviewing these 12 dividend stocks with yields > 3% that combine yield above 3% with stock market exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com