A Look At Innodata (INOD) Valuation After BWS Financial Top Pick Upgrade And New Government Contract

BWS Financial’s decision to name Innodata (INOD) a Top Pick, together with its focus on a new government contract and momentum in AI data services, has put fresh attention on the stock’s investment case.

See our latest analysis for Innodata.

The upgrade and government contract news arrives after a volatile stretch, with a 7 day share price return of 25.67% and a 90 day share price decline of 30.20%. At the same time, the 1 year total shareholder return of 74.18% and the very large 3 year and 5 year total shareholder returns suggest that longer term momentum has been strong.

If AI data services are on your radar, it can help to see how peers are trading too. You can start with high growth tech and AI stocks.

With the shares at US$64.03 and one analyst target at US$93.75, plus strong multiyear total returns already on the board, you have to ask whether Innodata is still mispriced or if the market is already banking on future growth.

Most Popular Narrative Narrative: 31.7% Undervalued

Compared to Innodata’s last close at US$64.03, the most followed narrative points to a higher fair value and frames the recent rally in a different light.

Company investment focus on proprietary tooling, simulation/agent-based AI data, and technical capabilities allows margin expansion opportunities through operational leverage and automation, supporting long-term improvements in EBITDA and net income.

Want to know what is sitting behind that margin story? The narrative leans on ambitious revenue compounding, shifting profit margins, and a rich future earnings multiple. Curious which assumptions really carry the fair value?

Result: Fair Value of $93.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if key tech clients scale back spending, or if automation and cheaper AI data tools start to pressure pricing and margins.

Find out about the key risks to this Innodata narrative.

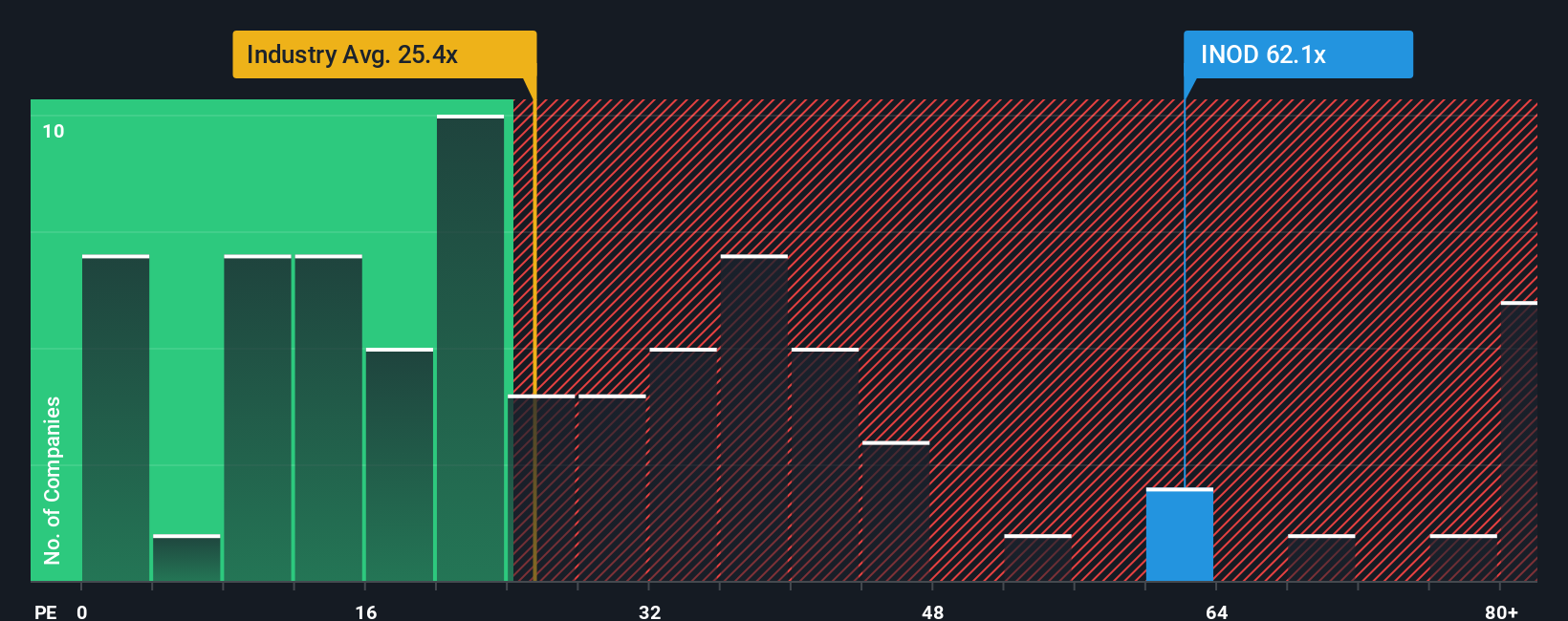

Another View: Rich P/E Ratios Tell a Different Story

If the narrative points to undervaluation, the P/E numbers pull you in the opposite direction. Innodata trades on a P/E of 60.6x, compared with 24.8x for the US Professional Services industry and 39.1x for peers, while its fair ratio sits at 26.2x. That gap points to meaningful valuation risk if sentiment cools. Which signal do you weigh more heavily: the upbeat narrative or the rich multiple on today’s earnings?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Innodata Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a custom view in minutes by starting with Do it your way.

A great starting point for your Innodata research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Innodata has caught your attention, do not stop there. Broader context across other themes can sharpen your judgment and help you spot opportunities sooner.

- Target potential mispricings by scanning these 884 undervalued stocks based on cash flows that may offer stronger fundamentals at prices the market has not fully appreciated yet.

- Ride the AI trend more thoughtfully by checking out these 27 AI penny stocks that sit at the crossroads of data, algorithms, and real-world commercial use cases.

- Position yourself early in emerging tech by reviewing these 29 quantum computing stocks that are working on hardware and software for next generation computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com