A Look At Copa Holdings (NYSE:CPA) Valuation After Share Price Surge On 2026 Growth Optimism

Why Copa Holdings Stock Is Back in Focus

Copa Holdings (NYSE:CPA) has drawn fresh attention after a recent share price surge tied to optimism about air travel demand, passenger revenue growth and fleet expansion, even as earnings estimates have softened.

See our latest analysis for Copa Holdings.

The recent spike that took Copa Holdings to a fresh 52 week high, alongside its 10.93% 1 month share price return and 54.69% 1 year total shareholder return, points to momentum building rather than fading as investors reassess future growth and risk.

If Copa’s move has you watching airlines more closely, it could be a good moment to widen your research and see how aerospace and defense stocks are pricing in demand and risk today.

With Copa delivering a 54.69% 1 year total return, trading at US$130.31 and sitting about 20% below the average analyst target of US$156.87, you have to ask: is there still a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 16.6% Undervalued

With Copa Holdings last closing at US$130.31 against a narrative fair value of about US$156, the current price sits below that fair value anchor.

The fair value estimate has edged down slightly to about $156 from roughly $157, reflecting modestly weaker top line assumptions partially offset by better margins.

The future P/E has been trimmed slightly to roughly 10.2x from about 10.5x, suggesting a somewhat more conservative view on Copa Holdings forward valuation multiple.

Curious what combination of revenue growth, margin expansion and future earnings multiple has to line up to support that fair value gap? The answers rest inside this narrative.

Result: Fair Value of $156 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could change quickly if fuel costs move sharply away from the US$2.47 per gallon assumption, or if competitive pressure keeps pushing passenger yields lower.

Find out about the key risks to this Copa Holdings narrative.

Another View On Copa’s Valuation

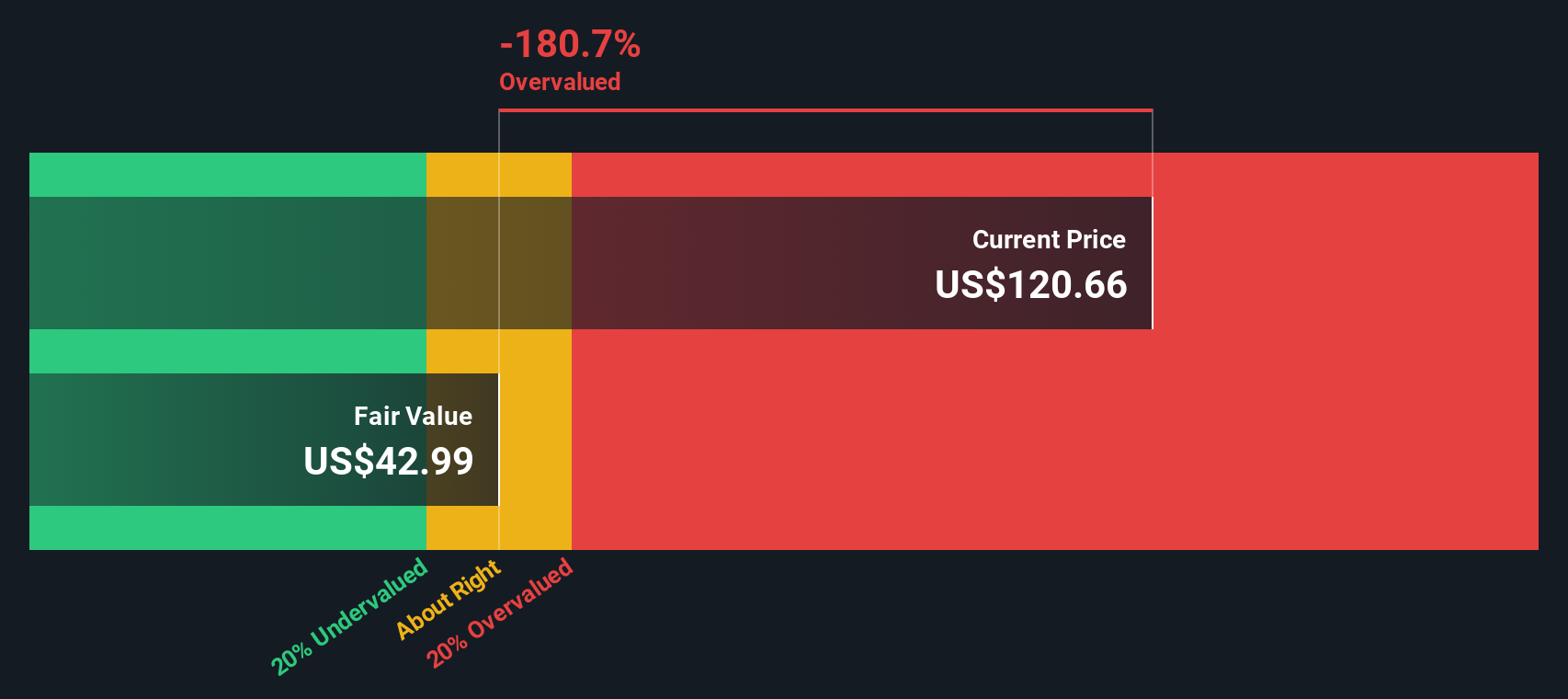

Our SWS DCF model paints a very different picture to the 16.6% undervalued narrative, with Copa at US$127.42 screened as expensive versus a fair value estimate of US$44.80. That flags valuation risk instead of upside. Which story feels closer to how you see the next few years playing out?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Copa Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 880 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Copa Holdings Narrative

If that view does not quite line up with your own thinking, you can weigh the same data yourself and build a tailored thesis in minutes, Do it your way.

A great starting point for your Copa Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Copa has sharpened your focus, do not stop here. This is the moment to cast a wider net and line up your next potential opportunities.

- Spot early growth stories by reviewing these 3542 penny stocks with strong financials that combine smaller size with stronger financial footing than you might expect.

- Position yourself at the front of the AI wave by scanning these 27 AI penny stocks that are already tying artificial intelligence to real business models.

- Target value opportunities by checking these 880 undervalued stocks based on cash flows where prices and cash flow estimates currently tell a different story to the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com