A Look At Americas Gold And Silver’s Valuation As Crescent Mine Upgrades Accelerate

Why the Crescent Silver Mine update matters for Americas Gold and Silver

Americas Gold and Silver (TSX:USA) is back in focus after the company outlined rapid progress at its recently acquired Crescent Silver Mine in Idaho, highlighting cost reductions and preparations for a planned mid-2026 production restart.

See our latest analysis for Americas Gold and Silver.

The Crescent update lands after a strong run, with the latest 90 day share price return of 29.12% and a very large 1 year total shareholder return suggesting momentum has been building rather than fading, even after a 4.36% one day share price pullback to CA$7.45.

If you are looking beyond precious metals for your next idea, this could be a good moment to widen the search and uncover fast growing stocks with high insider ownership.

With the share price already up 29.12% over 90 days and analysts’ average price target sitting at CA$9.38 versus a CA$7.45 close, you have to ask: is Americas Gold and Silver still mispriced, or is the Crescent upside already in the market?

Most Popular Narrative: 20.5% Undervalued

Against a last close of CA$7.45, the most followed narrative points to a fair value of about CA$9.38, framing Crescent as a key swing factor.

The transition to the higher-grade silver-copper EC120 at Cosalá, with commercial production expected by year-end 2025, promises significant increases in silver output and free cash flow, directly boosting consolidated revenue and improving cash generation.

The company's growing exposure to silver (now 82% of revenue), aligns Americas Gold and Silver to benefit from increasing industrial and investment demand for silver in sectors like green technology and electronics, which could support higher realized prices and revenue growth.

Curious how a higher grade mine plan, rising margins, and a richer silver mix combine into that fair value? The core assumptions might surprise you. One growth lever, in particular, carries most of the weight. Want to see which one it is and how it feeds into the valuation math?

Result: Fair Value of $9.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there is still meaningful execution risk, with high all in sustaining costs and concentrated operations at Galena and Cosalá, which could unsettle the bullish narrative.

Find out about the key risks to this Americas Gold and Silver narrative.

Another View: Rich Sales Multiple Raises Questions

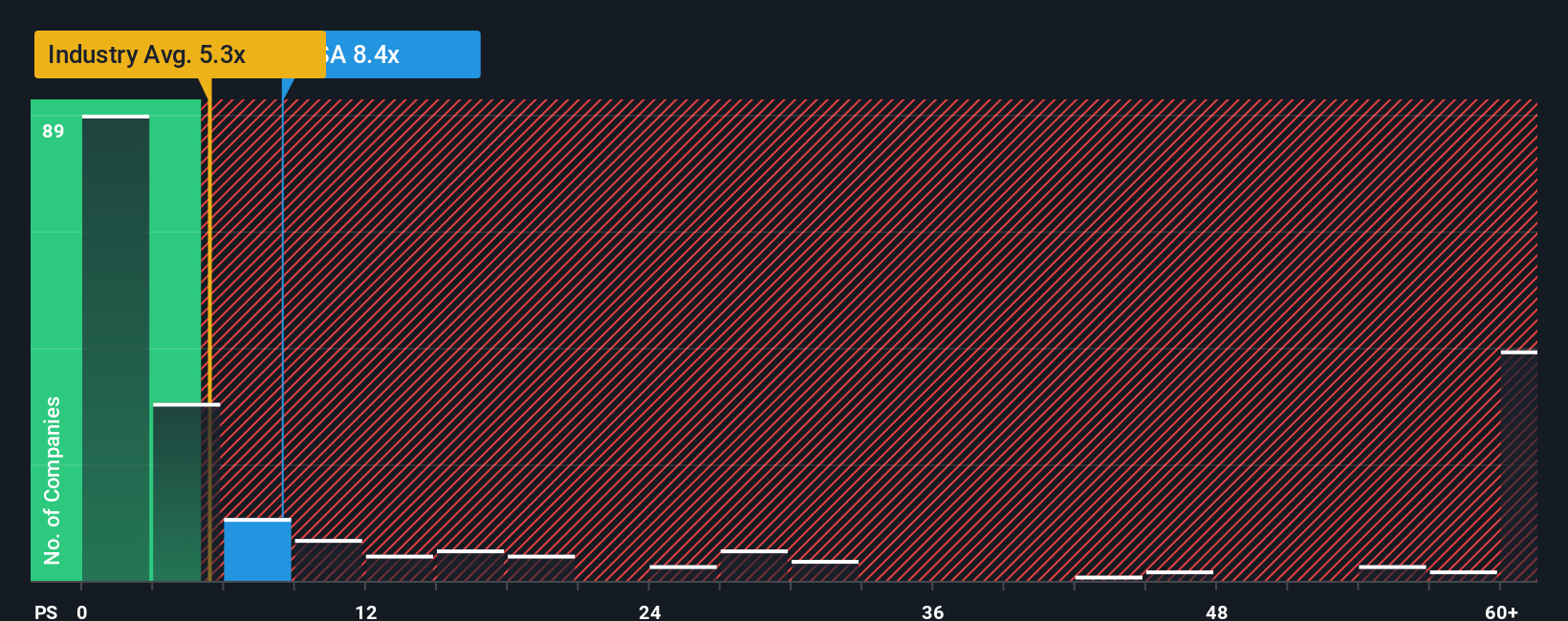

The fair value narrative points to Americas Gold and Silver trading about 29.6% below an intrinsic estimate, yet the share price tells a different story when you look at sales. On a P/S of 15.7x, the stock sits well above the Canadian metals and mining average of 7.4x and the peer average of 13.4x. It is also above a fair ratio of 4.2x that the market could move towards over time.

That gap suggests investors are already paying a high price for each dollar of current revenue. The question is whether future growth plays out strongly enough to justify staying above that fair ratio, or whether the P/S eventually drifts closer to it.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Americas Gold and Silver Narrative

If you look at the numbers and come to a different conclusion, that is fine. You can quickly build your own view using Do it your way.

A great starting point for your Americas Gold and Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop here, you could miss opportunities that fit your style even better. Keep pushing your research and let data guided tools surface fresh ideas.

- Spot potential value plays early by zeroing in on these 878 undervalued stocks based on cash flows that screen well on cash flow based metrics.

- Back bold growth themes by scanning these 79 cryptocurrency and blockchain stocks for companies tied to digital assets and blockchain infrastructure.

- Turn income goals into a focused watchlist by filtering for these 12 dividend stocks with yields > 3% that consistently offer higher yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com