A Look At CBRE Group (CBRE) Valuation After Recent Share Price Momentum

CBRE Group stock update

CBRE Group (CBRE) has attracted fresh attention after recent share price moves, with the stock showing a 0.2% decline over the past day but gains over the past week and month.

See our latest analysis for CBRE Group.

The recent 7 day share price return of 3.2% and 30 day return of 6.4% sit within a broader picture where the year to date share price return is 3.6%. The 1 year total shareholder return of 27.9% and 5 year total shareholder return of 166.6% point to strong long term compounding, which suggests momentum has been building over time, even if short term moves remain mixed.

If CBRE Group has you looking at real estate exposure, it could also be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With CBRE Group delivering a 27.9% 1 year total return and trading around $165.96 against an average analyst target near $183, the key question now is whether there is still a buying opportunity or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 9.1% Undervalued

The most followed narrative sees CBRE Group’s fair value at US$182.58, above the last close of US$165.96. This frames the current debate around upside potential.

The strong balance sheet and improved cash flow position allow CBRE to invest aggressively in M&A and principal investments, potentially driving higher future earnings and improved financial performance during economic downturns. CBRE's successful integration of Turner & Townsend is projected to enhance the project management segment's growth and margin profile over time, providing increased SOP margins and contributing to earnings growth through operational synergies and efficiency gains.

Curious what kind of revenue trajectory, margin lift, and future P/E multiple are baked into that valuation gap, and how buybacks factor in as well? The full narrative lays out the numbers and the logic holding it all together.

Result: Fair Value of $182.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on transactional activity holding up, with tariff uncertainty and interest rate swings both capable of cooling deal flow and pressuring CBRE Group’s earnings power.

Find out about the key risks to this CBRE Group narrative.

Another Angle On Valuation

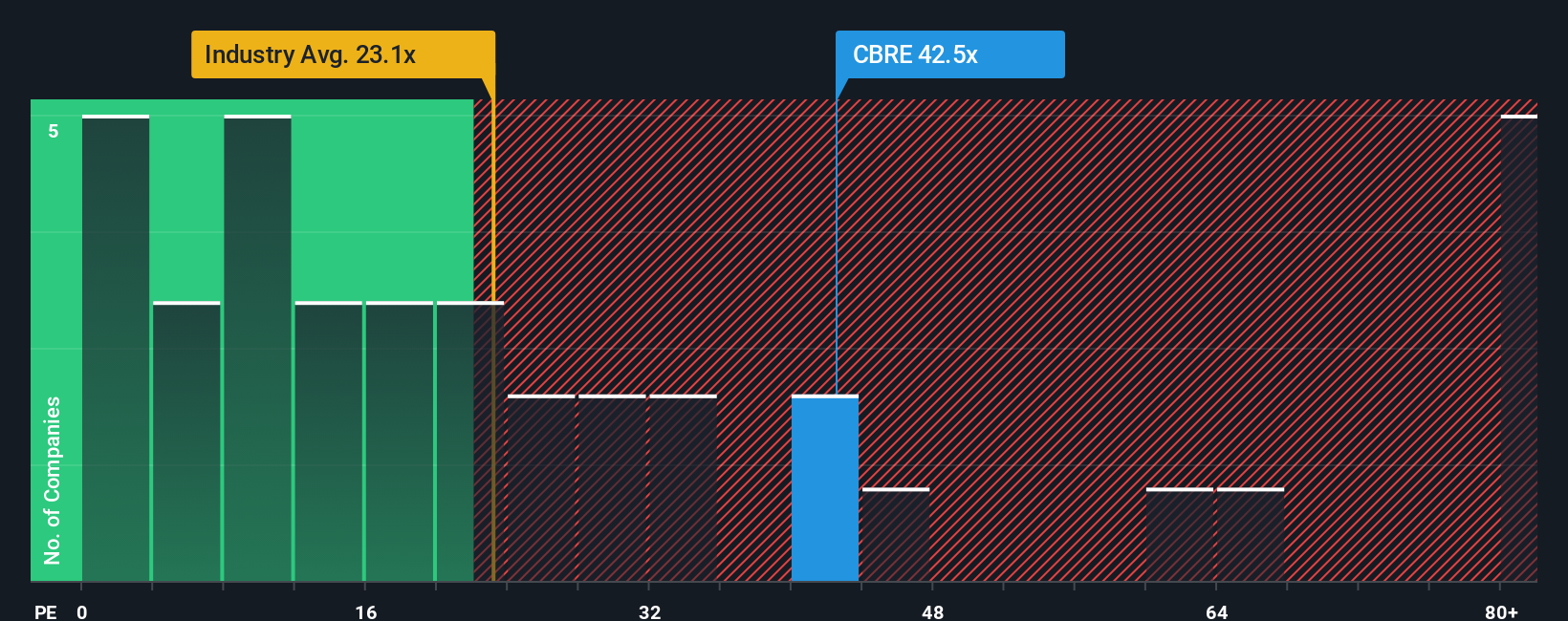

So far, the popular narrative leans on future earnings and a higher fair value of US$182.58. If you shift the lens to the current P/E of 39.6x, the picture looks less forgiving, with CBRE Group screening as expensive versus the US Real Estate industry at 30.7x and peers at 28.4x.

On top of that, our fair ratio for CBRE Group sits at 25.8x, well below the current 39.6x P/E. Put simply, the share price already bakes in a rich earnings multiple, which could mean less room for error if growth or margins come in softer than expected. Which view do you think better matches your own expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CBRE Group Narrative

If this story does not fully align with your view of CBRE Group, you can stress test the same data and shape your own narrative in just a few minutes by starting with Do it your way.

A great starting point for your CBRE Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If CBRE Group is on your radar, do not stop there. A short session with a few focused screeners could surface opportunities you will not want to miss.

- Capture potential mispricing by scanning these 881 undervalued stocks based on cash flows that may offer more compelling entry points based on their cash flow profile.

- Ride long term technology shifts by reviewing these 28 AI penny stocks that are tied to artificial intelligence themes across different sectors.

- Boost your income focus by checking out these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com