A Look At Abbott Laboratories (ABT) Valuation After Libre Assist AI Diabetes Feature Launch

Abbott Laboratories (ABT) just introduced Libre Assist within its Libre app at CES 2026, using generative AI and continuous glucose data to give diabetes patients real time guidance on how upcoming meals might affect their glucose levels.

See our latest analysis for Abbott Laboratories.

The Libre Assist launch comes as Abbott’s share price sits at US$126.18, with a 30 day share price return of 4.07% and some recent volatility reflected in a 90 day share price return of a 4.82% decline, while the 1 year total shareholder return of 12.53% points to steadier long run compounding.

If you’re interested in how digital health tools like Libre Assist fit into a wider set of ideas, this could be a good moment to scan other healthcare stocks for fresh possibilities.

With ABT at US$126.18, a 12.53% 1 year total return and analysts’ average targets sitting higher, the real question is whether Libre driven growth leaves the stock undervalued or if the market already prices that in.

Most Popular Narrative Narrative: 12.6% Undervalued

With Abbott Laboratories at US$126.18 versus a most followed fair value estimate around US$144.43, the current price sits below that narrative anchor.

The analysts have a consensus price target of $142.485 for Abbott Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $159.0, and the most bearish reporting a price target of just $122.0.

Curious how a shrinking profit pool can still support a richer earnings multiple in a few years? Revenue expectations, margin reset and a premium P/E all sit at the core of this narrative.

Result: Fair Value of $144.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this hinges on diagnostics and Libre growth holding up, as prolonged pricing pressure, China volatility or a rich Exact Sciences deal could quickly challenge that undervalued story.

Find out about the key risks to this Abbott Laboratories narrative.

Another Angle On Value

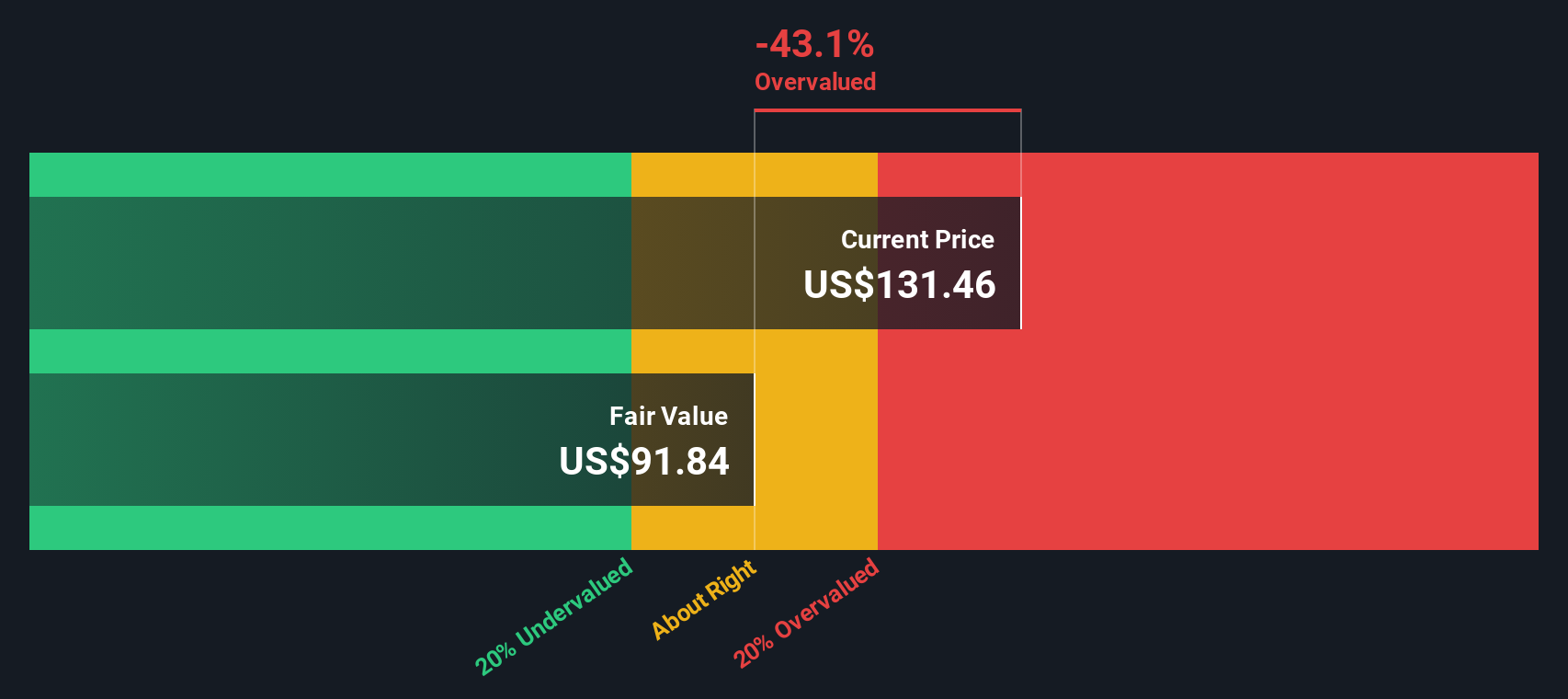

There is a twist when you set that 12.6% “undervalued” fair value of about US$144.43 beside the SWS DCF model. On that view, ABT at US$126.18 is trading above an estimated fair value of US$73.06, which points to an overvalued picture instead.

If one framework says the current price is below fair value and another puts it well above, which set of assumptions about long term margins, growth and discount rates do you think feels more realistic for Abbott?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Abbott Laboratories for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Abbott Laboratories Narrative

If the numbers or story here do not quite match your view, you can pull up the same data, stress test your own assumptions and Do it your way in just a few minutes.

A great starting point for your Abbott Laboratories research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready For More Investment Ideas?

If Abbott has your attention, do not stop here. The real edge often comes from lining up a few strong ideas, not just one.

- Target potential mispricings by scanning these 881 undervalued stocks based on cash flows that may offer more attractive entry points than widely followed large caps.

- Ride powerful technology trends by checking out these 28 AI penny stocks that tie real business models to artificial intelligence themes.

- Boost your income focus by reviewing these 11 dividend stocks with yields > 3% that put cash returns at the center of your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com