Moog (MOG.A) Valuation Check As Earnings Surprises And Investor Interest Spark Fresh Debate

Moog (MOG.A) is back on many investors’ screens after a series of earnings surprises over the last four quarters. This has aligned with stronger sentiment and fresh debate around what the stock is worth.

See our latest analysis for Moog.

Recent enthusiasm has also shown up in the trading data, with a 12.18% 30 day share price return and a 30.45% 1 year total shareholder return. This points to building momentum around Moog at the current US$262.98 share price.

If Moog has caught your attention, it could be a good moment to widen the lens and see how other aerospace and defense names are trading by scanning aerospace and defense stocks.

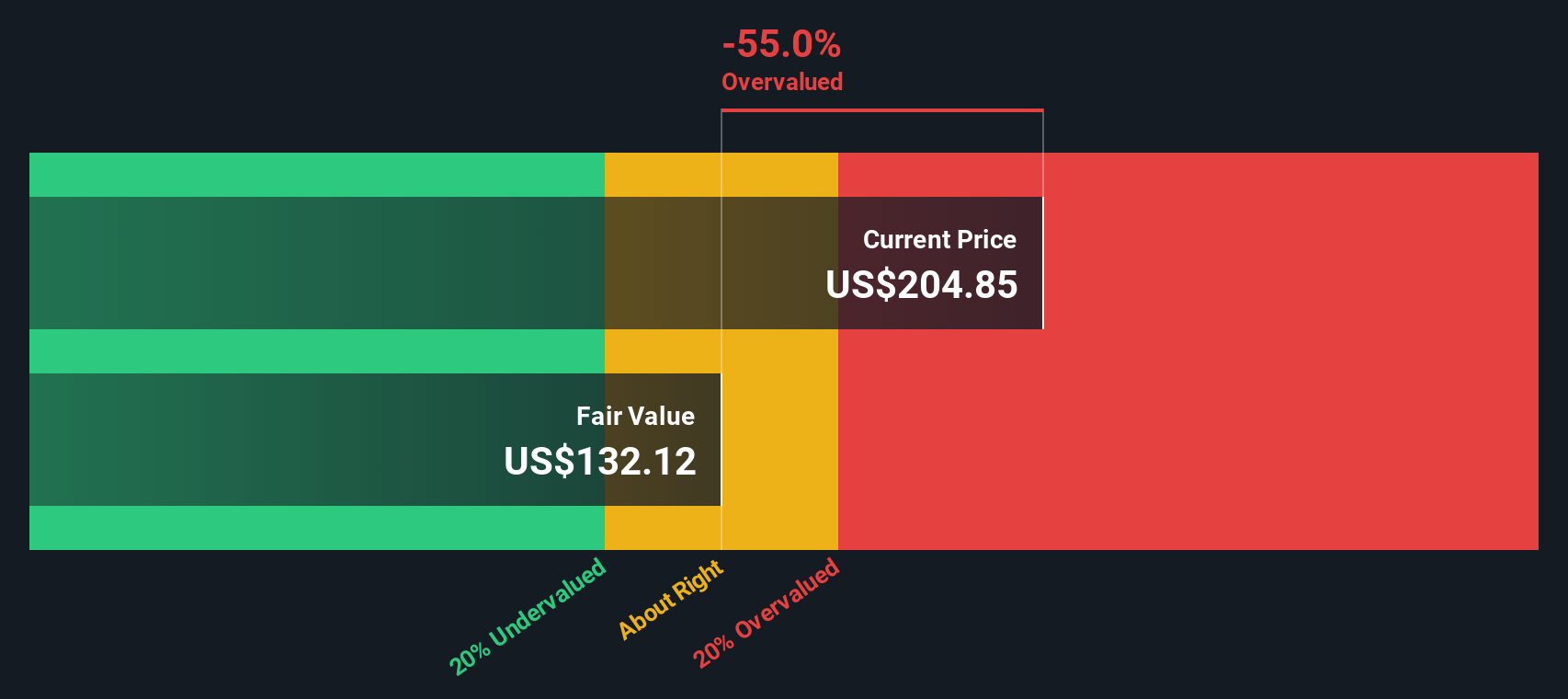

Moog's recent run, including a 3 year total return close to 2x and an intrinsic value estimate that sits below the current US$262.98 price, raises the key question for investors: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 2.5% Overvalued

The most followed valuation work puts Moog’s fair value at US$256.50, just below the recent US$262.98 close, which implies a tight pricing gap.

Operational efficiency initiatives (including facility consolidation, divestiture of noncore product lines, and the 80/20 simplification program) are resulting in higher productivity and margin improvement; this should continue to drive both operating margins and free cash flow higher despite near-term tariff and working capital headwinds.

Curious what kind of revenue run rate, margin lift and future earnings multiple are all baked into that US$256.50 figure, using a 7.85% discount rate and multi year growth assumptions that point to higher profitability and a different earnings mix than today? The full narrative lays out the exact trajectory that needs to play out for that to hold.

Result: Fair Value of $256.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still meaningful risks around tariff costs squeezing margins and weaker than expected free cash flow conversion, which could challenge this fair value story.

Find out about the key risks to this Moog narrative.

Another View: DCF Points To A Different Story

While the most popular narrative suggests Moog is about 2.5% overvalued at US$256.50, our DCF model indicates a fair value estimate of US$345.36. At the current US$262.98 price, that implies Moog is trading around 24% below this fair value. Which version of “fair” do you find more convincing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Moog for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 881 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Moog Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can build a tailored Moog story in minutes by starting with Do it your way.

A great starting point for your Moog research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If Moog is just the start of your research, this is the moment to broaden your watchlist with other focused ideas that could sharpen your next move.

- Spot potential value opportunities early by checking these 881 undervalued stocks based on cash flows that are priced below what their cash flows imply.

- Hunt for growth stories in cutting edge automation and software by scanning these 28 AI penny stocks with exposure to artificial intelligence themes.

- Strengthen your income stream by reviewing these 11 dividend stocks with yields > 3% that aim to offer more substantial cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com