Amgen (AMGN) Valuation Check After DISCO Oncology Deal And Fresh Analyst Optimism

Amgen (AMGN) has just entered an exclusive license agreement with DISCO Pharmaceuticals, giving it global rights to develop cancer therapies based on DISCO's cell surface proteomics platform. This move directly targets new oncology opportunities.

See our latest analysis for Amgen.

That DISCO Pharmaceuticals agreement comes on top of a busy few days for Amgen, including the up to $840 million Dark Blue Therapeutics cancer deal and an upgrade from UBS. The shares trade at $330.11 after a 5.18% 1 month share price return and a 29.01% 1 year total shareholder return, suggesting recent momentum has been building.

If this kind of oncology activity has your attention, it could be a good moment to scan other healthcare stocks that fit your approach and compare how they stack up against Amgen.

With Amgen trading at $330.11, almost in line with one major analyst price target and flagged as having a high intrinsic discount, the key question is whether recent oncology deals leave upside on the table or if markets already factor in future growth.

Most Popular Narrative Narrative: 1% Overvalued

With Amgen closing at $330.11 against a most-followed fair value of about $327.74, the narrative frames the current price as slightly ahead of its modeled worth.

Operational efficiencies and large-scale digital transformation, including AI-driven innovation and digitized workflows, are expected to enhance productivity across R&D and commercial operations, supporting higher net margins and improved long-term earnings power.

Curious what kind of revenue path, margin lift and future earnings multiple are baked into that slight premium? The narrative combines moderated growth assumptions with a richer future P/E and a discount rate that keeps every change in those inputs meaningful.

Result: Fair Value of $327.74 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still need to weigh risks such as drug pricing pressure and biosimilar competition, which could challenge margins and weaken the case for a premium P/E.

Find out about the key risks to this Amgen narrative.

Another Angle: Earnings Multiple Signals “Good Value”

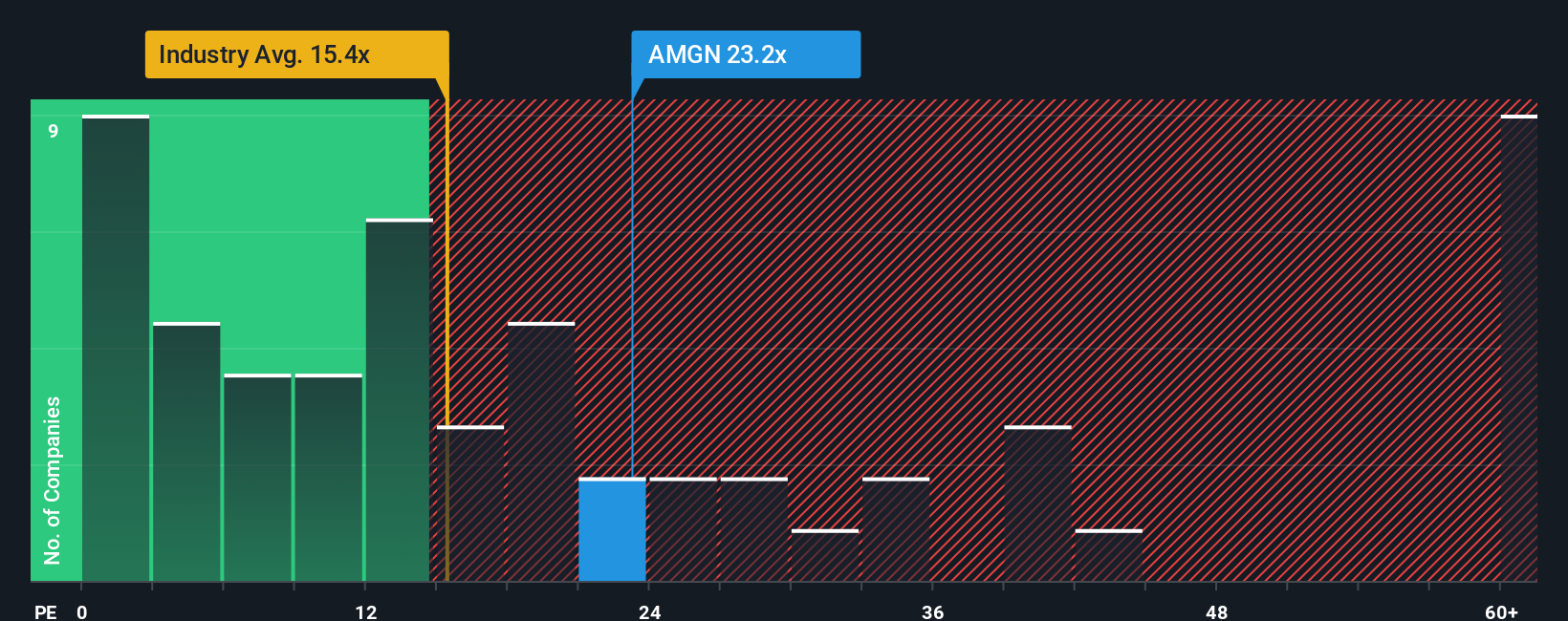

While the most followed fair value of about US$327.74 frames Amgen as roughly fairly priced, the P/E picture is a little different. At 25.4x earnings, Amgen sits well below the peer average of 59.4x and only slightly under its own fair ratio of 27.4x, which points to more moderate valuation risk than some biotech names. The question is whether that gap reflects caution around debt and patent expiries or a potential opportunity if earnings keep tracking consensus.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Amgen Narrative

If you would rather test the numbers yourself instead of relying on this framework, you can build a custom view of Amgen in just a few minutes, Do it your way

A great starting point for your Amgen research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready To Hunt For Your Next Idea?

If Amgen has sharpened your interest, do not stop here. Use the screener to quickly spot other stocks that might fit your style before others do.

- Spot potential bargains by checking out these 881 undervalued stocks based on cash flows that line up with the cash flow profiles you want to focus on.

- Target future focused themes by scanning these 28 AI penny stocks shaping how data, automation and digital tools reshape entire industries.

- Collect income ideas by reviewing these 11 dividend stocks with yields > 3% that might suit a portfolio built around regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com