Why Investors Shouldn't Be Surprised By Beijing Beida Jade Bird Universal Sci-Tech Company Limited's (HKG:8095) 41% Share Price Surge

Beijing Beida Jade Bird Universal Sci-Tech Company Limited (HKG:8095) shares have had a really impressive month, gaining 41% after a shaky period beforehand. The last month tops off a massive increase of 243% in the last year.

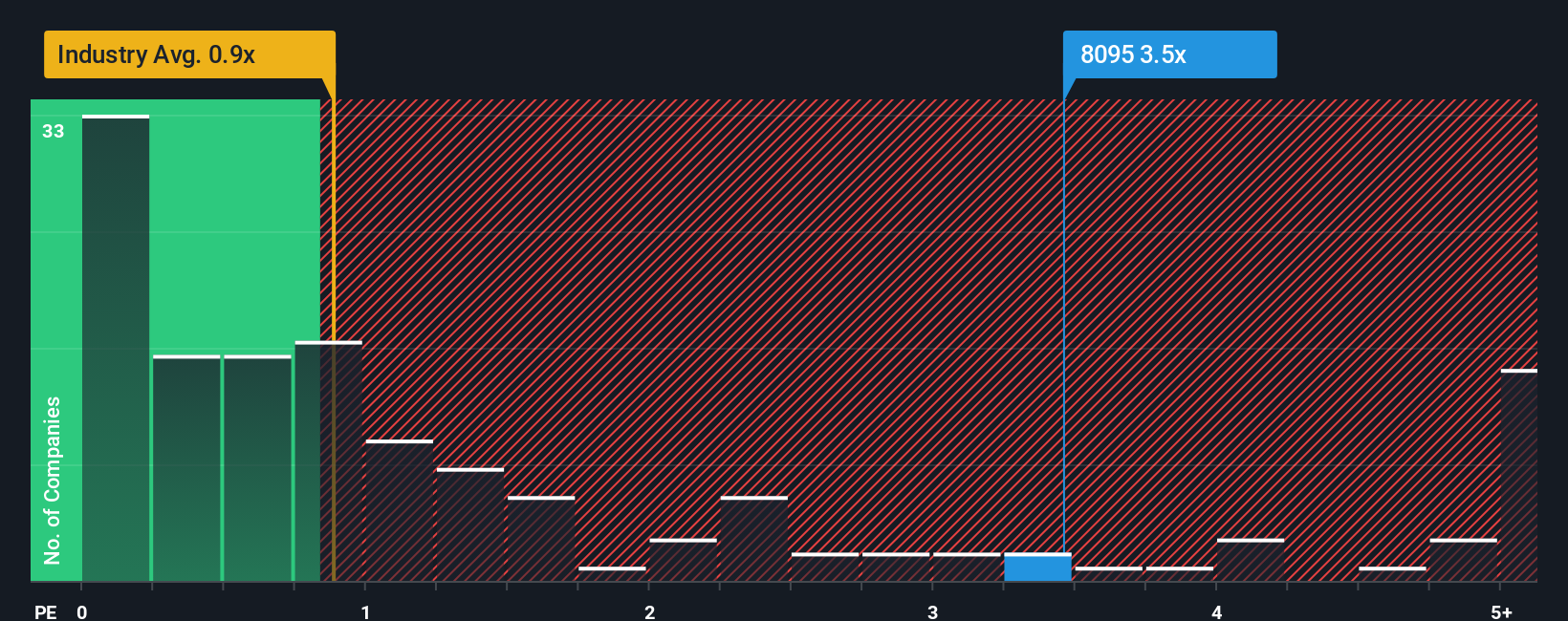

Following the firm bounce in price, you could be forgiven for thinking Beijing Beida Jade Bird Universal Sci-Tech is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 3.5x, considering almost half the companies in Hong Kong's Industrials industry have P/S ratios below 0.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Beijing Beida Jade Bird Universal Sci-Tech

How Beijing Beida Jade Bird Universal Sci-Tech Has Been Performing

Revenue has risen at a steady rate over the last year for Beijing Beida Jade Bird Universal Sci-Tech, which is generally not a bad outcome. Perhaps the market believes the recent revenue performance is strong enough to outperform the industry, which has inflated the P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Beijing Beida Jade Bird Universal Sci-Tech's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Beijing Beida Jade Bird Universal Sci-Tech?

Beijing Beida Jade Bird Universal Sci-Tech's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.0%. The latest three year period has also seen an excellent 111% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

When compared to the industry's one-year growth forecast of 10%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Beijing Beida Jade Bird Universal Sci-Tech's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

The strong share price surge has lead to Beijing Beida Jade Bird Universal Sci-Tech's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Beijing Beida Jade Bird Universal Sci-Tech revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Beijing Beida Jade Bird Universal Sci-Tech, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.