Adyen (ENXTAM:ADYEN) Valuation After Wolfe Research Upgrade And Fintech Growth Drivers

Wolfe Research upgrade puts Adyen’s model in focus

Wolfe Research’s recent upgrade of Adyen (ENXTAM:ADYEN) to Outperform centers on its payment technology, embedded financial products, and expanding customer base, while also pointing to broader fintech sector catalysts in 2026.

See our latest analysis for Adyen.

Adyen’s share price has picked up recently, with a 1 month share price return of 8.83% and a 7 day share price return of 3.89%. However, the 1 year total shareholder return of a 1.41% decline and 5 year total shareholder return of an 18.86% decline show that longer term momentum has been weaker as investors reassess growth prospects and risk across fintech.

If this kind of payment and fintech story has your attention, it could be a good moment to broaden your watchlist with high growth tech and AI stocks.

With the shares still below some analyst targets and recent revenue and net income growth near 16%, the key question is whether Adyen is quietly undervalued or if the market is already baking in the next leg of growth.

Most Popular Narrative: 19.9% Undervalued

Adyen’s most followed narrative points to a fair value of about €1,813 versus the last close of €1,451.60, putting the spotlight on what is driving that gap.

Modularization and innovation (such as risk/fraud services, Intelligent Routing) enable differentiated, value-added pricing and higher take rates, which should support net margin expansion as operating leverage from scale continues to materialize.

Curious what kind of growth path could back that valuation? The narrative leans heavily on rising margins, richer revenue per merchant, and a premium earnings multiple. The full set of assumptions is where the story really gets interesting.

Result: Fair Value of €1,812.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside story hinges on continued enterprise wins and product uptake. Tougher competition and higher regulatory costs could quickly challenge the margin and growth assumptions behind it.Find out about the key risks to this Adyen narrative.

Another Angle on Valuation

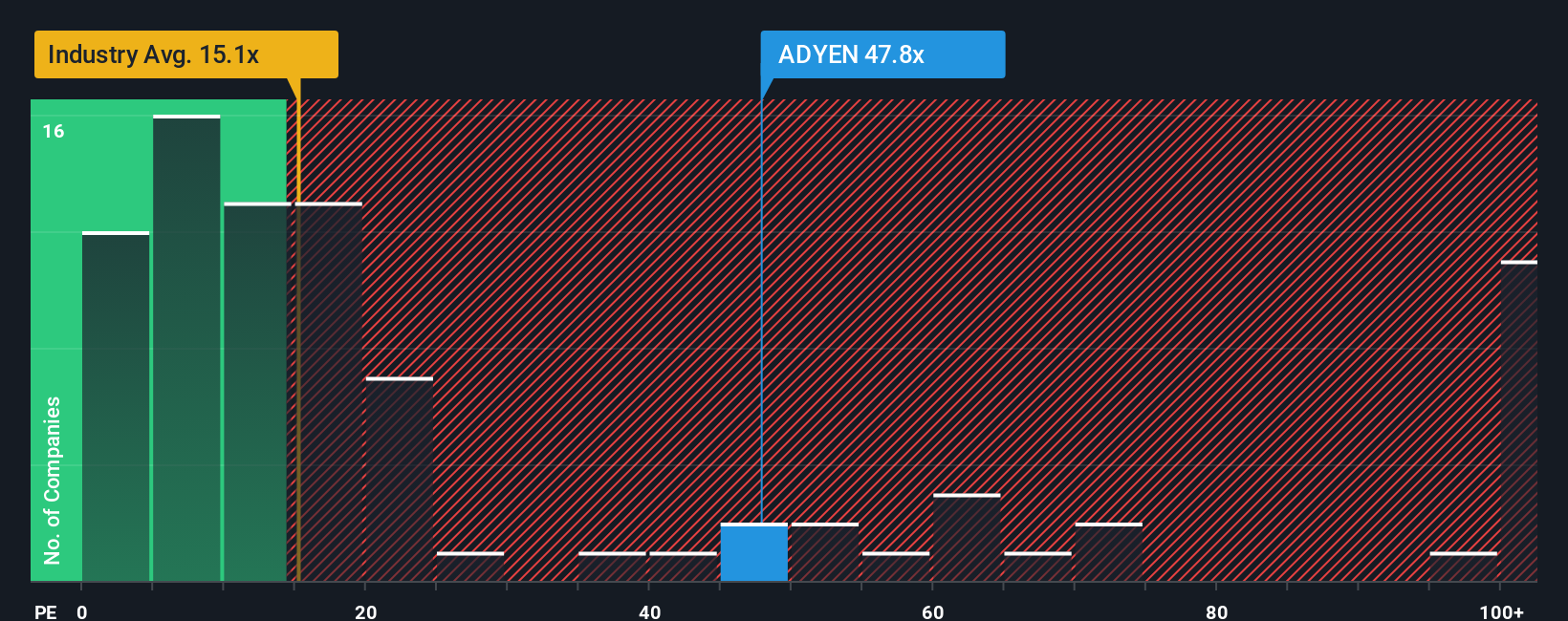

The analyst narrative leans on future earnings to argue Adyen looks about 19.9% undervalued, but today the shares trade on a P/E of 45.9x. That is more than triple the European Diversified Financial industry at 14x and the peer average of 13.5x, and also well above a fair ratio of 20.6x.

Put simply, the current price already assumes a lot of success. If sentiment shifts or growth assumptions cool, that gap to the 20.6x fair ratio gives a sense of how much the market could reprice. The key consideration is whether Adyen has earned that premium or not.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Adyen Narrative

If this version of the story does not quite fit your view, you can stress test the same data, set your own assumptions and Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Adyen.

Looking for more investment ideas?

If Adyen is on your radar, do not stop there. Widen your options with screeners that surface very different types of opportunities across the market.

- Spot earlier stage opportunities by scanning these 3541 penny stocks with strong financials that already show stronger financial foundations than many of their peers.

- Ride the surge in automation and data by checking out these 28 AI penny stocks that are tying artificial intelligence to real business models.

- Target potential value gaps by reviewing these 877 undervalued stocks based on cash flows where prices look low relative to underlying cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com