Rocket Lab (RKLB) Stock Is Soaring Friday: What's Driving The Action?

Rocket Lab Corp (NASDAQ:RKLB) shares are trading higher Friday afternoon after Morgan Stanley upgraded the stock from Equal-Weight to Overweight and raised its price target from $67 to $105.

The stock otherwise traded lower Thursday following a downgrade from Keybanc. Here’s what investors need to know.

- Rocket Lab stock is at critical resistance. Why is RKLB stock breaking out?

Why Keybanc Sees Limited Upside Ahead

Keybanc analyst Michael Leshock downgraded Rocket Lab from an Overweight rating to a Sector Weight rating, indicating that the stock’s growth catalysts are already reflected in its current valuation.

Despite this downgrade, Keybanc maintains that Rocket Lab is among the highest-quality companies in the space sector, citing several recent milestones, including an $816 million contract award and the opening of a new launch pad.

The firm also pointed to broader developments in the space sector, such as increased interest following SpaceX’s reported IPO intentions and notable appointments within NASA. While the downgrade reflects a balanced risk-reward profile in the near term, Keybanc suggests that improved visibility into upcoming launches could lead to a more positive outlook.

Rocket Lab’s Bullish Momentum: A Game Changer?

Rocket Lab is currently trading 18.8% above its 20-day simple moving average (SMA) and 57.5% above its 100-day SMA, indicating strong short-term and long-term bullish trends. Shares have skyrocketed by 291.92% over the past 12 months and are currently positioned closer to their 52-week highs than lows.

The RSI is at 71.99, which is considered overbought, suggesting that a pullback may be imminent if momentum wanes. Meanwhile, the MACD is above its signal line, reinforcing the bullish outlook for the stock.

The combination of an overbought RSI and a bullish MACD suggests that while the stock is currently strong, traders should remain cautious of potential corrections.

- Key Resistance: $100.00

- Key Support: $90.00

Earnings Report Anticipation: What Investors Expect

Investors are looking ahead to the next earnings report on February 26.

- EPS Estimate: Loss of 9 cents (Up from Loss of 10 cents YoY)

- Revenue Estimate: $178.29 million (Up from $132.39 million YoY)

Analyst Consensus & Recent Actions: The stock carries a Buy Rating with an average price target of $56.15. Recent analyst moves include:

- Morgan Stanley: Upgraded to Overweight (Raised Target to $105.00) (Jan. 16)

- Keybanc: Upgraded to Sector Weight (Jan. 15)

- Needham: Buy (Raised Target to $90.00) (Dec. 23, 2025)

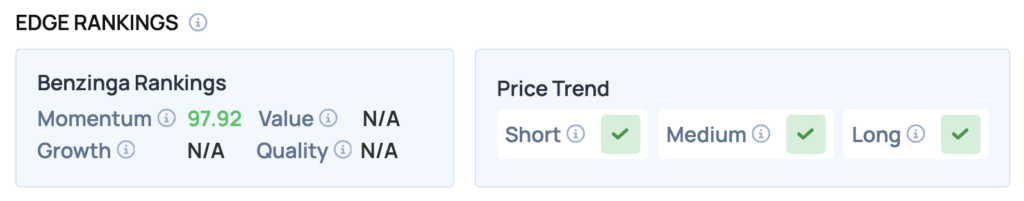

Benzinga Edge Rankings

Below is the Benzinga Edge scorecard for Rocket Lab, highlighting its strengths and weaknesses compared to the broader market:

- Momentum: Bullish (Score: 97.92/100) — Stock is outperforming the broader market.

The Verdict: Rocket Lab’s Benzinga Edge signal reveals a strong momentum setup. The high momentum score indicates that the stock is currently in a favorable position, suggesting that traders may want to capitalize on this upward trend.

Top ETF Exposure

- SPDR S&P Aerospace & Defense ETF (NYSE:XAR): 5.66% Weight

- First Trust Indxx Aerospace & Defense ETF (NYSE:MISL): 4.81% Weight

- ARK Space & Defense Innovation ETF (NASDAQ:ARKX): 7.62% Weight

Significance: Because RKLB carries such a heavy weight in these funds, any significant inflows or outflows for these ETFs will likely force automatic buying or selling of the stock.

RKLB Shares Soar Friday

RKLB Price Action: Rocket Lab shares were up 7.28% at $97.37 at the time of publication on Friday, according to Benzinga Pro data.

Image: Shutterstock