Chongqing Machinery & Electric Co., Ltd.'s (HKG:2722) Shares Leap 27% Yet They're Still Not Telling The Full Story

Despite an already strong run, Chongqing Machinery & Electric Co., Ltd. (HKG:2722) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 213% following the latest surge, making investors sit up and take notice.

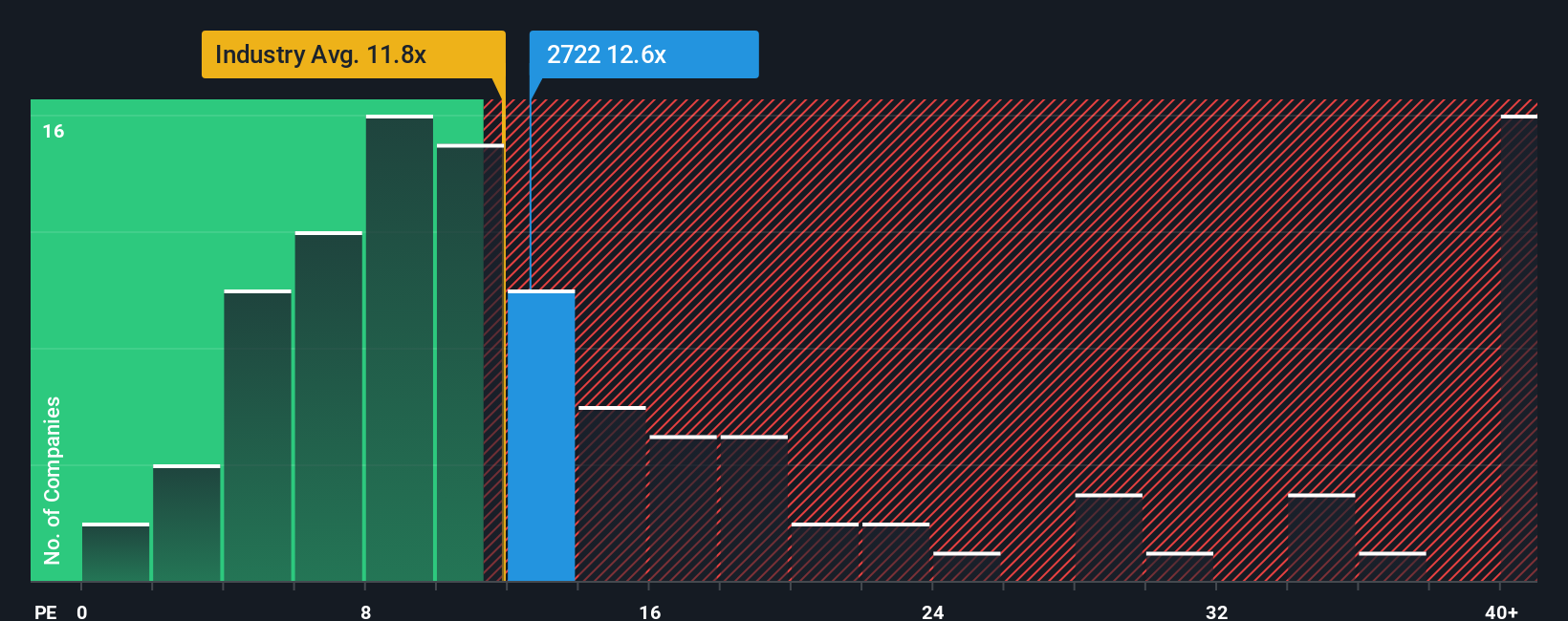

Although its price has surged higher, it's still not a stretch to say that Chongqing Machinery & Electric's price-to-earnings (or "P/E") ratio of 13.6x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been advantageous for Chongqing Machinery & Electric as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Chongqing Machinery & Electric

Is There Some Growth For Chongqing Machinery & Electric?

In order to justify its P/E ratio, Chongqing Machinery & Electric would need to produce growth that's similar to the market.

If we review the last year of earnings growth, the company posted a terrific increase of 62%. The strong recent performance means it was also able to grow EPS by 75% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 24% each year as estimated by the one analyst watching the company. With the market only predicted to deliver 14% each year, the company is positioned for a stronger earnings result.

With this information, we find it interesting that Chongqing Machinery & Electric is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Chongqing Machinery & Electric's P/E

Chongqing Machinery & Electric's stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Chongqing Machinery & Electric's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Chongqing Machinery & Electric that you need to be mindful of.

Of course, you might also be able to find a better stock than Chongqing Machinery & Electric. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.