What 7 Analyst Ratings Have To Say About Diamondback Energy

Ratings for Diamondback Energy (NASDAQ:FANG) were provided by 7 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

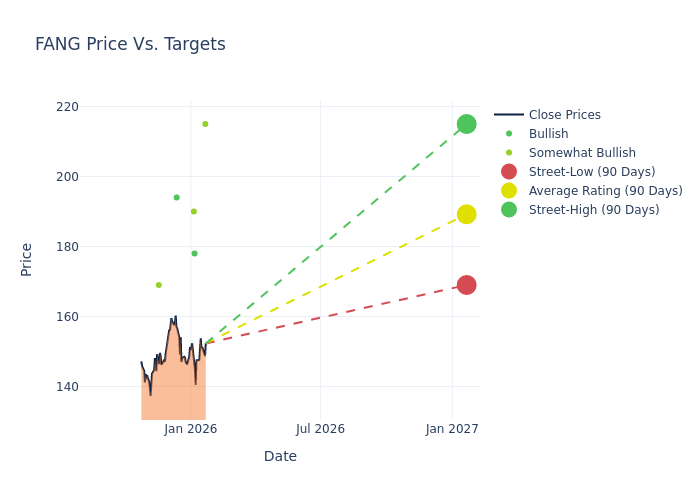

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $191.29, with a high estimate of $219.00 and a low estimate of $169.00. This current average reflects an increase of 1.06% from the previous average price target of $189.29.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of Diamondback Energy's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Mark Lear | Piper Sandler | Lowers | Overweight | $215.00 | $219.00 |

| Scott Gruber | Citigroup | Lowers | Buy | $178.00 | $180.00 |

| Bob Brackett | Bernstein | Lowers | Outperform | $190.00 | $199.00 |

| Josh Silverstein | UBS | Raises | Buy | $194.00 | $174.00 |

| Mark Lear | Piper Sandler | Lowers | Overweight | $219.00 | $222.00 |

| Hanwen Chang | Wells Fargo | Raises | Overweight | $169.00 | $160.00 |

| Josh Silverstein | UBS | Raises | Buy | $174.00 | $171.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Diamondback Energy. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Diamondback Energy compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Diamondback Energy's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Diamondback Energy's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Diamondback Energy analyst ratings.

Discovering Diamondback Energy: A Closer Look

Diamondback is a crude oil and natural gas exploration and production firm whose operations represent a pure-play in the US Permian Basin. The company went public in 2012 and has established itself as a top-tier independent producer through disciplined acquisition and operational excellence. The company's most transformational transaction occurred in September 2024 with the completion of its $26 billion merger with Endeavor Energy Resources, which added around 470,000 net acres and doubled Diamondback's total acreage position. Diamondback boasts an enviable position in the Midland sub-basin, with some of the lowest unit costs among its Permian peers.

A Deep Dive into Diamondback Energy's Financials

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: Diamondback Energy's remarkable performance in 3M is evident. As of 30 September, 2025, the company achieved an impressive revenue growth rate of 48.18%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Energy sector.

Net Margin: Diamondback Energy's net margin is impressive, surpassing industry averages. With a net margin of 26.06%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Diamondback Energy's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.61%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Diamondback Energy's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 1.37%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Diamondback Energy's debt-to-equity ratio is below the industry average. With a ratio of 0.42, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.