Stock Market Today: S&P 500, Dow Jones Futures Rise As Trump Scales Down EU Tariff Threats—Microsoft, Moderna, Intel In Focus

U.S. stock futures rose on Thursday following Wednesday’s gains. Futures of major benchmark indices were higher.

The indices settled higher on Wednesday, gaining more than 1% during the session after President Donald Trump abruptly withdrew his latest round of tariff threats.

He stated that planned tariffs on European Union countries will no longer take effect following what he described as a “very productive” meeting with NATO Secretary General Mark Rutte.

Meanwhile, the 10-year Treasury bond yielded 4.24%, and the two-year bond was at 3.59%. The CME Group's FedWatch tool‘s projections show markets pricing a 95% likelihood of the Federal Reserve leaving the current interest rates unchanged in January.

| Index | Performance (+/-) |

| Dow Jones | 0.41% |

| S&P 500 | 0.65% |

| Nasdaq 100 | 0.93% |

| Russell 2000 | 0.62% |

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Thursday. The SPY was up 0.64% at $689.76, while the QQQ advanced 0.90% to $621.80.

Stocks In Focus

Intel

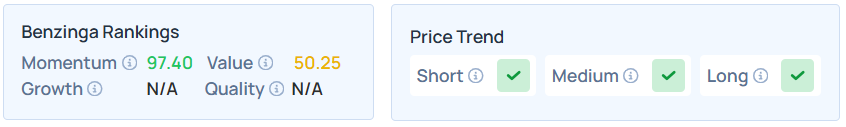

- Intel Corp. (NASDAQ:INTC) was 1.60% higher in premarket on Thursday as it is projected to post quarterly earnings of 8 cents per share on revenue of $13.38 billion after the closing bell.

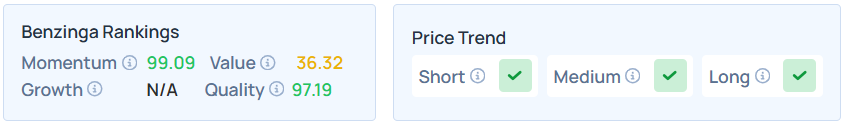

- INTC maintains a stronger price trend over the short, medium, and long terms with a moderate value ranking, as per Benzinga’s Edge Stock Rankings.

Microsoft

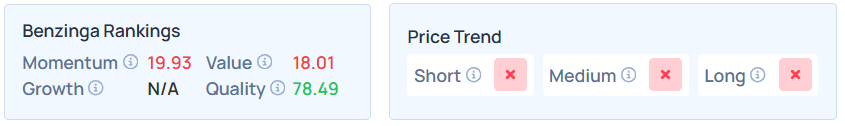

- Microsoft Corp. (NASDAQ:MSFT) rose 1.06% after and the announced a multiyear partnership with the Mercedes-AMG PETRONAS F1 Team to integrate its cloud and AI technologies across the racing team’s operations, aiming to drive innovation and performance efficiency from the factory to the circuit.

- Benzinga’s Edge Stock Rankings indicate that MSFT maintains a weak price trend over the short, medium, and long terms, with a robust quality ranking.

Moderna

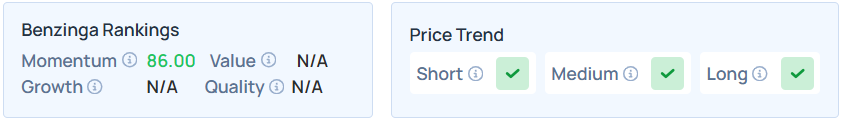

- Moderna Inc. (NASDAQ:MRNA) jumped 5.64% after its recent update on a cancer therapy study fueled investor enthusiasm. The study, conducted in collaboration with Merck & Co. Inc. (NYSE:MRK), showed that adding Moderna's intismeran autogene to KEYTRUDA significantly reduced the risk of recurrence or death in melanoma patients.

- MRNA maintains a stronger price trend over the short, medium, and long term, as per Benzinga’s Edge Stock Rankings.

The Metals Company

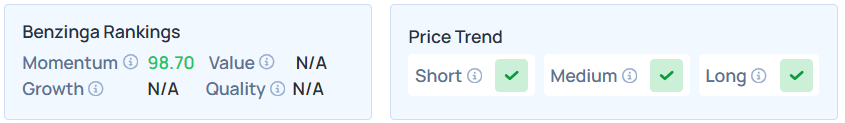

- The Metals Company Inc. (NASDAQ:TMC) gained 5.51% after it welcomed a new rule by the National Oceanic and Atmospheric Administration that modernizes regulations for deep-seabed mining permits.

- TMC maintains a stronger price trend over the short, medium, and long terms, as per Benzinga’s Edge Stock Rankings.

Micron Technology

- Micron Technology Inc. (NASDAQ:MU) popped 2.73% after CEO Sanjay Mehrotra highlighted the current memory chip shortage, attributing it to the increasing demand for artificial intelligence (AI) across various sectors.

- Benzinga’s Edge Stock Rankings shows that MU maintains a stronger price trend over the short, medium, and long term, with a solid quality ranking.

Cues From Last Session

Energy, materials, and health care stocks recorded the biggest gains on Wednesday as all sectors on the S&P 500 closed on a positive note.

| Index | Performance (+/-) | Value |

| Dow Jones | 1.21% | 49,077.23 |

| S&P 500 | 1.16% | 6,875.62 |

| Nasdaq Composite | 1.18% | 23,224.82 |

| Russell 2000 | 2.00% | 2,698.17 |

Insights From Analysts

BlackRock maintains a “pro-risk” investment stance for early 2026, driven by the transformative power of artificial intelligence (AI) and a supportive macroeconomic backdrop.

They expect the Federal Reserve to continue cutting interest rates, facilitated by a softening labor market and declining inflation. Specifically, they remain overweight on U.S. equities, noting that “strong corporate earnings… are supported by a favorable macro backdrop”.

However, this optimism is tempered by caution regarding fiscal sustainability and institutional integrity. BlackRock warns that “renewed concerns over Fed independence… may challenge that view”.

Despite these political risks, they argue that financial realities will ultimately constrain policy extremes, stating, “We think immutable economic laws are still at play… that any rapid rise in long-term yields would quickly impact debt sustainability”.

Consequently, they prefer equities over government bonds, keeping an underweight position on long-term U.S. Treasuries due to the “risk of holding long-term U.S. bonds… due to worries over fiscal sustainability”.

Upcoming Economic Data

Here's what investors will be keeping an eye on Thursday.

- Initial jobless claims data for the week ending Jan. 17 and the first revision of the third-quarter’s GDP will be out by 8:30 a.m. November’s delayed report for personal income, spending, and PCE data will be announced by 10:00 a.m. ET.

Commodities, Gold, Crypto, And Global Equity Markets

Crude oil futures were trading lower in the early New York session by 0.92% to hover around $60.06 per barrel.

Gold Spot US Dollar fell 0.32% to hover around $4,815.26 per ounce. Its last record high stood at $4,888.22 per ounce. The U.S. Dollar Index spot was 0.02% lower at the 98.7420 level.

Meanwhile, Bitcoin (CRYPTO: BTC) was trading 0.81% higher at $90,024.43 per coin.

Asian markets closed higher on Thursday, as China’s CSI 300, Hong Kong's Hang Seng, South Korea's Kospi, Japan's Nikkei 225, India’s Nifty 50, and Australia's ASX 200 indices rose. European markets were mostly higher in early trade.

Photo courtesy: Shutterstock