Bank on the banks

BANKS are hardly “exciting” but, at current valuations, they offer some upside to investors against a backdrop of anticipated economic growth and emerging market rotational play.

Malaysian banking stocks “are a solid, defensive” investment, says Datuk Seri Cheah Cheng Hye, chairman of Cheah Capital, a Hong Kong-based family office.

“Banks in Malaysia seem well-capitalised and offer dividend yields of 4% to 6%. However, their prospects are only moderate in an economy with a moderate 4% or 5% growth,” he tells StarBiz 7.

“Frankly speaking, most main Malaysian cities seem over-banked,” Cheah, who also tracks the Malaysian market, says.

However, he says, the recovery of the ringgit may encourage foreigners to buy in Malaysia but this may take time.

An analyst with a bank-backed brokerage says lenders offer a little more “positiveness” and “stability” than most other sectors – at least for now.

“I would say for banks, the upside is there for now, as we haven’t really seen significant foreign inflows to our market, year-to-date.

“Against the backdrop of the US Federal Reserve rate cut cycle and an emerging market rotational play, Malaysia is well positioned to be the next preferred investment location for foreigners, supported by our political stability as well as strengthening ringgit,” he tells StarBiz 7.

Banks will be the first in line for foreign buyers and this should inject a fresh, new trajectory in the share performance of our local banks, he adds.He says although regional banks may offer more upside, risks such as currency risks for the Indonesian market and geopolitical tensions for the Thailand market are downsides to this.

“In Singapore, stretched valuations remain a concern.

“For Malaysian banks, although return on equity and yields are slightly less than abovementioned markets, our politics are generally more stable and the strengthening of the ringgit will provide more compelling upside, in the future.”

Fortress Capital Group chief executive officer Datuk Thomas Yong says as Malaysia’s gross domestic product is expected to grow at around 4.5% this year, there is support for decent loan growth expectations of around 5% for the banking sector.

“In addition, net interest margins are expected to improve as deposit rates are priced lower going forward. Most bank shares are offering attractive dividend yields of around 5% at current shares prices,” Yong says.

Potential rerating

He says there is also a potential rerating from write-backs in provisions.

“Overall, the banking sector offers a decent risk reward profile at current levels although price-to-book valuations have significantly recovered.”

In its latest report on the banking sector, Hong Leong Investment Bank (HLIB) Research says the compression in net interest margins of banks are expected to fully dissipate by the second half of this year, facilitated by the tail-end of fixed deposit repricing following the July 2025 overnight policy rate (OPR) cut.

It projects the OPR to hold steady at 2.75% throughout 2026, providing a more stable environment for interest income.

On a sequential basis, topline growth will likely be driven more significantly by non-interest income or NOII, specifically through strengthened bancassurance contributions and fee-based income.

HLIB Research also notes that despite the turmoil last year which was caused by heightened geopolitical tensions and policy uncertainty, system loan growth remained steady above the circa 5% level as of November last year, closely tracking a decent real gross domestic product growth of 4.7% for 3Q25.

Moving into 2026, it expects this momentum to be sustained, anchored by a robust private sector and the thematic tailwinds from the Visit Malaysia 2026 campaign, which it expects will specifically stimulate the retail, services and manufacturing sectors.

“Furthermore, the small medium enterprise space is well positioned as a primary growth driver, benefiting from enhanced access to government-backed financing and guarantees totalling RM50bil as announced in Budget 2026.”

However, HLIB Research notes that it remains wary of a potential slowdown in export growth as frontloading effects dissipate.

The prevailing “wait-and-see” sentiment among large corporates may also persist amidst ongoing global instability.

“Consequently, we project sector loan growth to hold steady within the 4.8% to 5.3% range, premised on our in-house 2026 gross domestic product forecast of 4.5% (vs 4.8% in 2025),” it adds.

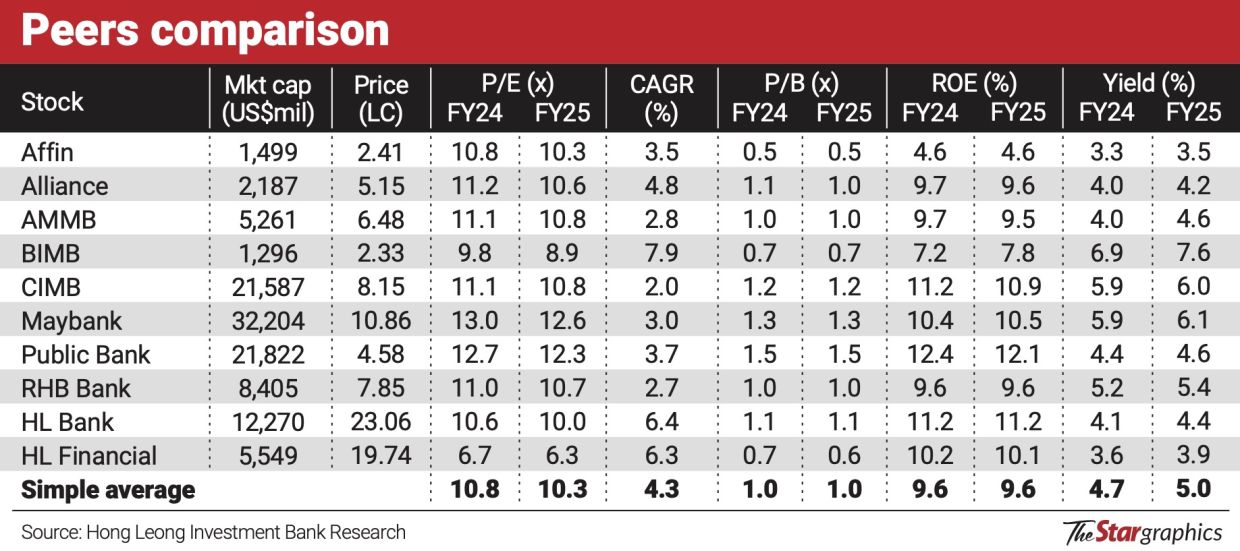

It has “buy” calls on Affin Bank Bhd, Alliance Bank Malaysia Bhd, AMMB Holdings Bhd, CIMB Group Holdings Bhd, Malayan Banking Bhd (Maybank), Public Bank Bhd and RHB Bank Bhd.

On the other hand, it is maintaining its “hold” call on Bank Islam Malaysia Bhd given its limited upside profile.

HLIB Research says despite the recent strength in the banking sector’s share prices, it believes there is still room for further rerating to play out in 2026.

Notably, the sector remains fundamentally undervalued – currently trading at a price to book of 0.95 times, which sits well below the five-year pre-Covid mean of 1.21 times, while delivering a healthy return on equity of 9.7%.

“We continue to advocate a broad-based buying strategy, nominating Maybank, CIMB, and Alliance as our top picks for the first half of 2026.”