Should You Invest $500 in NuScale Power Right Now?

Key Points

NuScale Power is designing small modular reactors (SMRs).

It has not deployed its nuclear technology commercially, and it's burning cash.

The company has long-term potential, but the stock will likely be volatile in the near term.

NuScale Power (NYSE: SMR) is a nuclear technology company trying to change how we build nuclear power plants. In simple terms, it wants to build small nuclear reactors that can be produced in a factory. In practice, several of these reactors can be grouped together to generate larger amounts of power. The company's technology could serve a range of applications, but the most talked-about use case right now is data centers.

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Data centers have a real need for the kind of 24/7 electricity that small modular reactors (SMRs) can produce. Several nuclear start-ups are vying to become the go-to power source for artificial intelligence, including Oklo and Nano Nuclear Energy, but so far, NuScale is the only U.S. company with an NRC-approved SMR design.

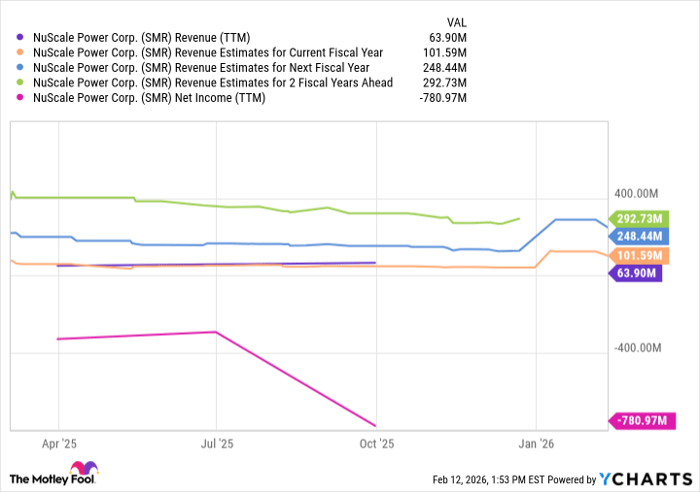

Even so, NuScale hasn't deployed an SMR for commercial use. The company is burning cash and reporting losses, and, by the looks of it, it may be a few years before the company generates significant revenue.

Data by YCharts.

NuScale stock carries a $4.5 billion market cap, which dwarfs its roughly $64 million in trailing-12-month revenue. At today's price, the nuclear stock trades at more than 70 times sales, which is expensive by any conventional measure.

A $500 investment in NuScale at this point is best reserved for investors who can stomach volatility. The company has long-term potential to meet surging demands for electricity. But it needs to prove it can turn its design into real projects.

Investors who can tolerate risk may want to stake $500 in this burgeoning energy company. Those who want exposure to nuclear energy but don't want to bet it all on one name may be better served by a nuclear energy exchange-traded fund (ETF).

Steven Porrello has positions in Oklo. The Motley Fool recommends NuScale Power. The Motley Fool has a disclosure policy.